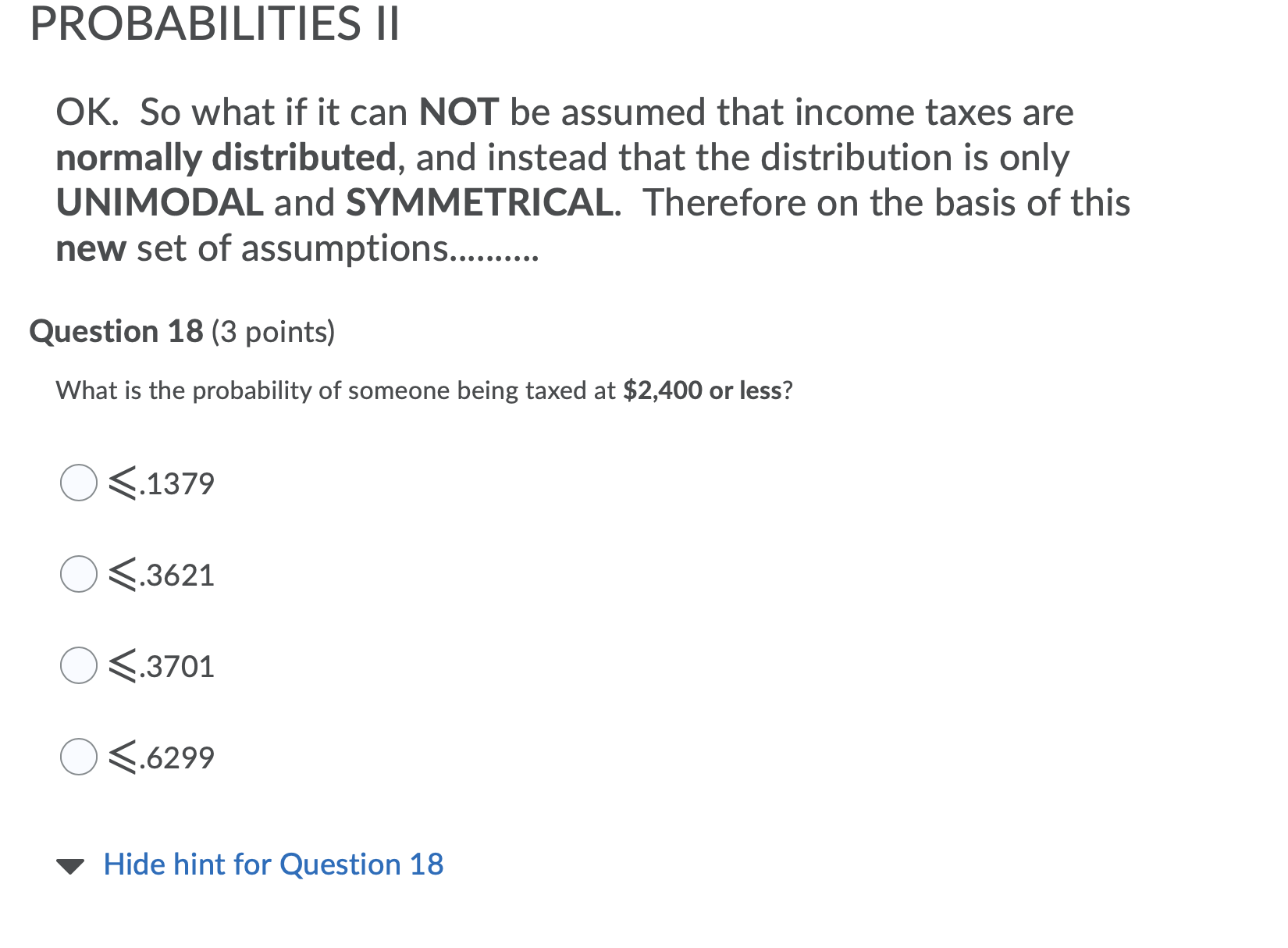

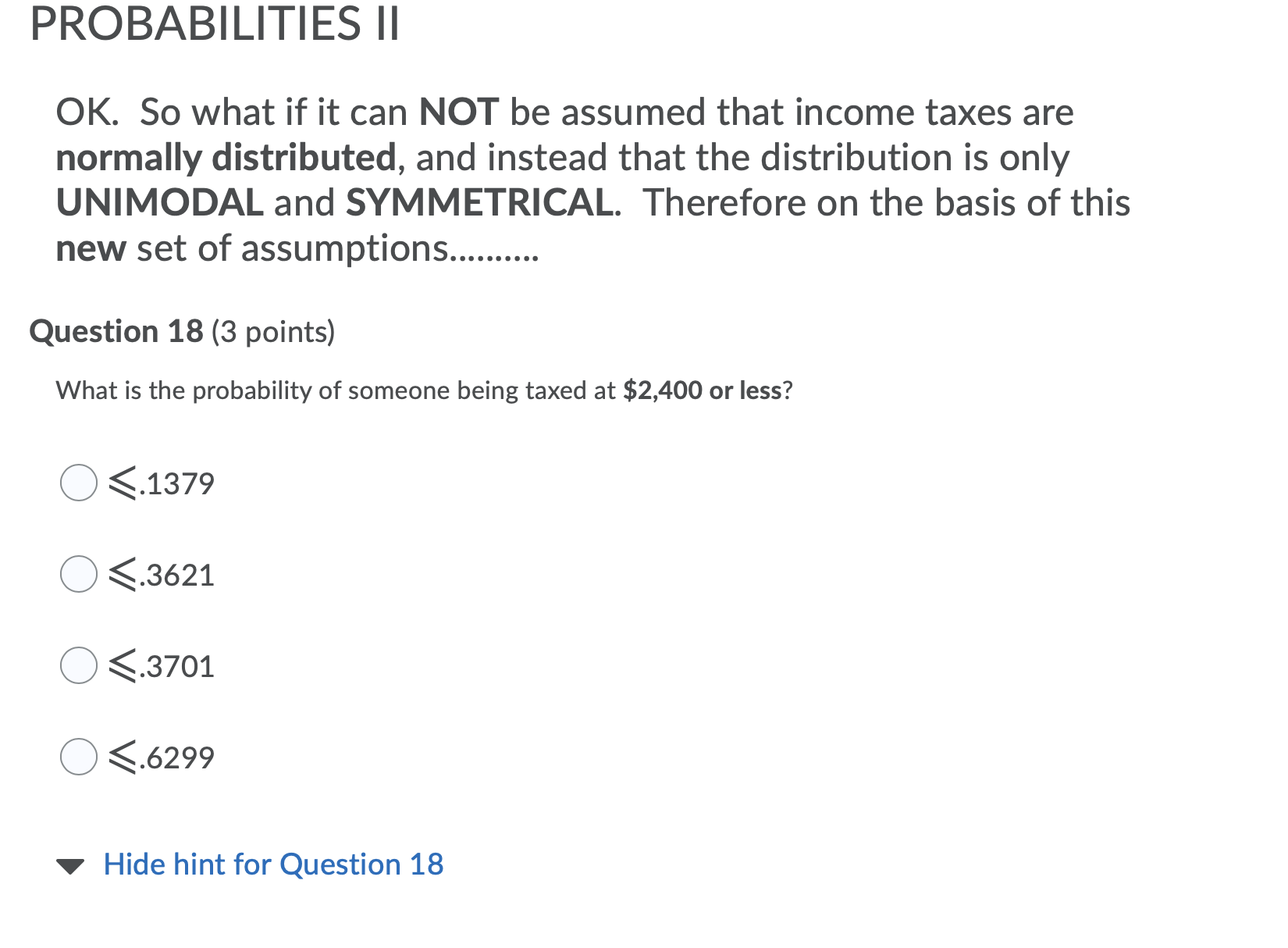

Question: PROBABILITIES || OK. So what if it can NOT be assumed that income taxes are normally distributed, and instead that the distribution is only UNIMODAL

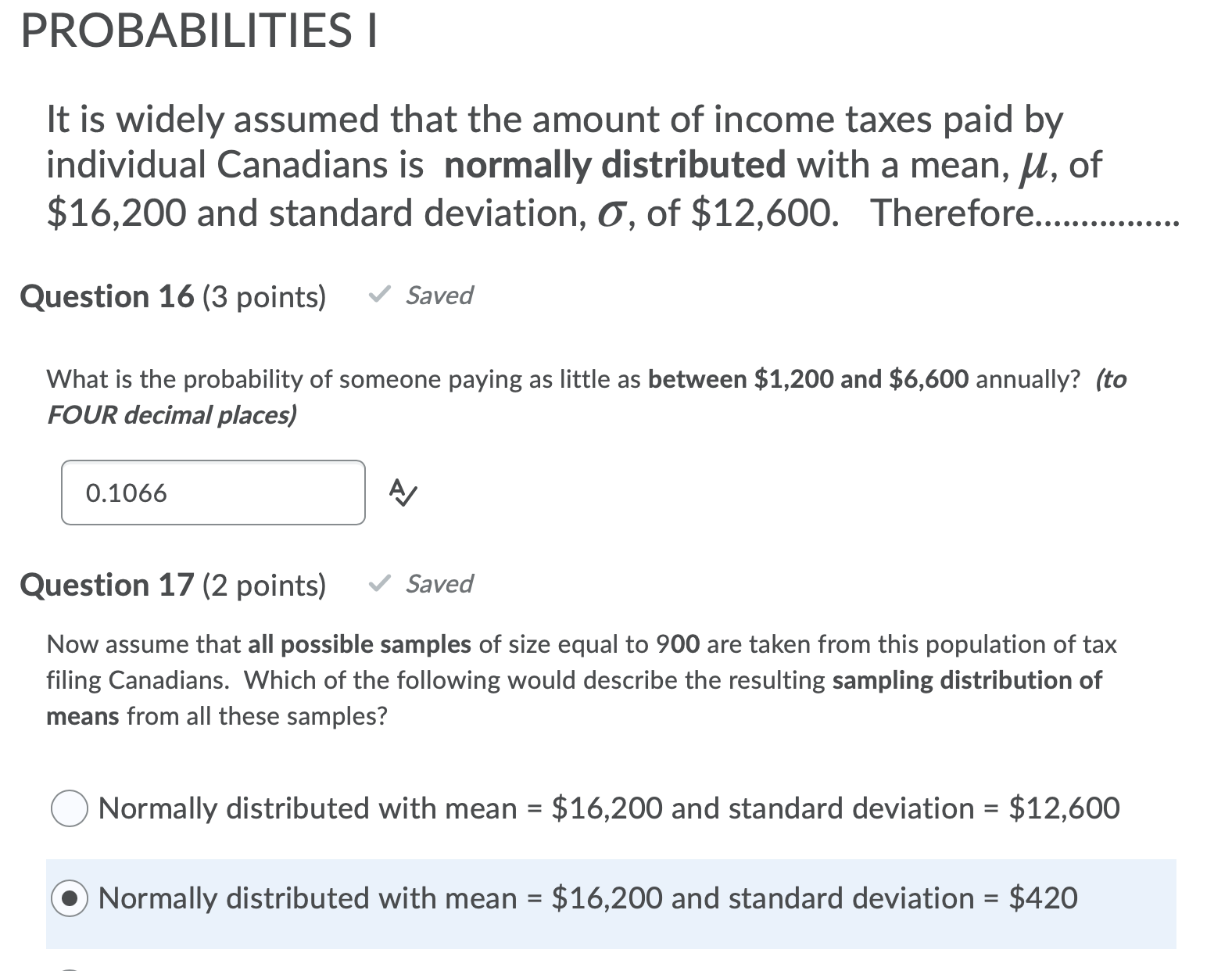

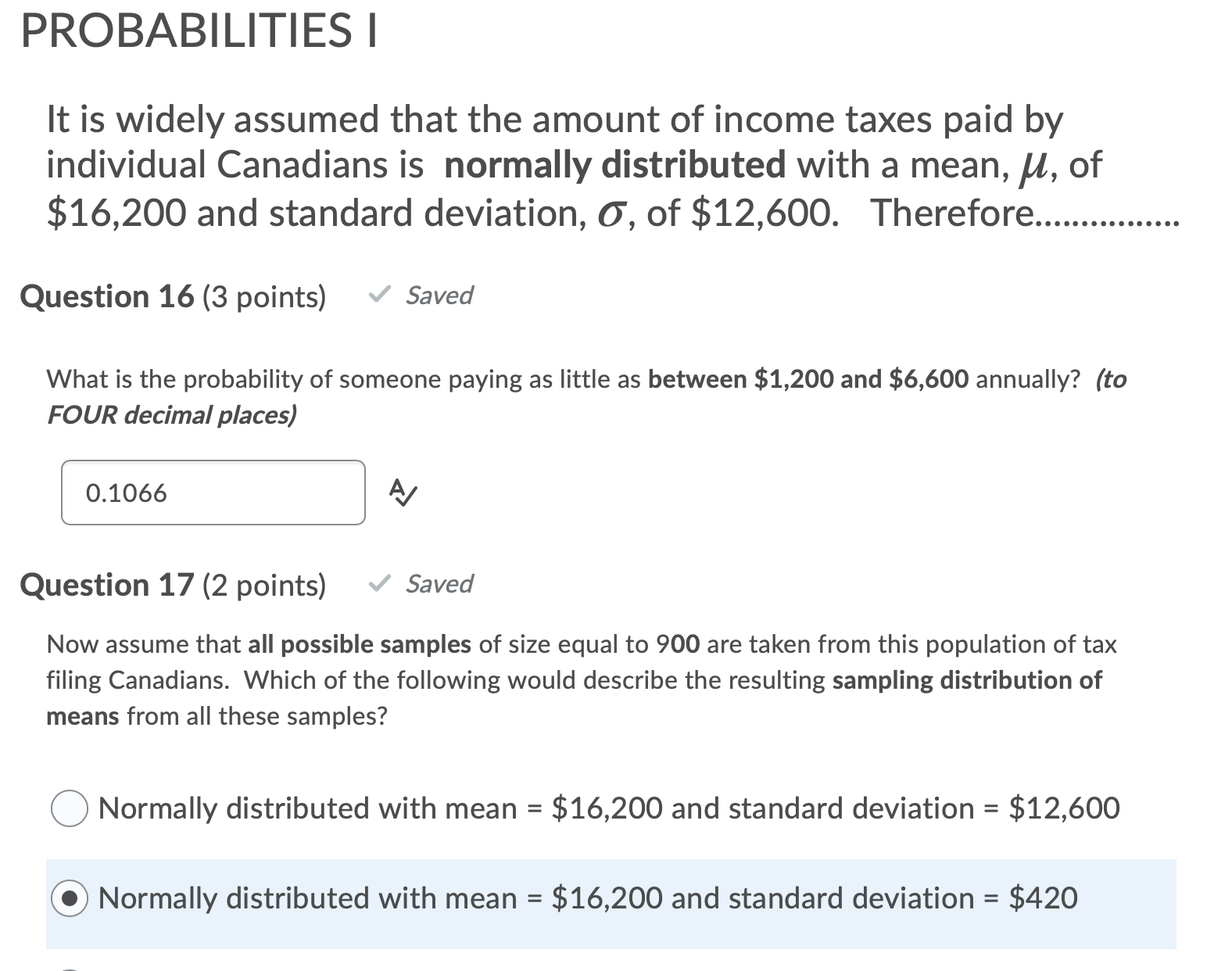

PROBABILITIES || OK. So what if it can NOT be assumed that income taxes are normally distributed, and instead that the distribution is only UNIMODAL and SYMMETRICAL. Therefore on the basis of this new set of assumptions .......... Question 18 (3 points) What is the probability of someone being taxed at $2,400 or less? Q $1379 v Hide hint for Question 18 PROBABILITIES I It is widely assumed that the amount of income taxes paid by individual Canadians is normally distributed with a mean, [1, of $16,200 and standard deviation, 0', of $12,600. Therefore ................ Question 16 (3 points) ~/ Saved What is the probability of someone paying as little as between $1,200 and $6,600 annually? (to FOUR decimal places) 0.1066 4/ Question 17 (2 points) ~/ Saved Now assume that all possible samples of size equal to 900 are taken from this population of tax filing Canadians. Which of the following would describe the resulting sampling distribution of means from all these samples? 0 Normally distributed with mean = $16,200 and standard deviation = $12,600 @ Normally distributed with mean = $16,200 and standard deviation = $420

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts