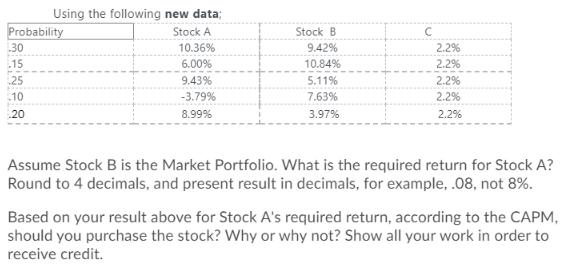

Question: Probability .30 15 25 Using the following new data; Stock A 10 20 10.36% 6.00% 9.43% -3.79% 8.99% Stock B 9.42% 10.84% 5,11% 7.63%

Probability .30 15 25 Using the following new data; Stock A 10 20 10.36% 6.00% 9.43% -3.79% 8.99% Stock B 9.42% 10.84% 5,11% 7.63% 3.97% C 2.2% 2.2% 2.2% 2.2% 2.2% Assume Stock B is the Market Portfolio. What is the required return for Stock A? Round to 4 decimals, and present result in decimals, for example, .08, not 8%. Based on your result above for Stock A's required return, according to the CAPM. should you purchase the stock? Why or why not? Show all your work in order to receive credit.

Step by Step Solution

3.42 Rating (149 Votes )

There are 3 Steps involved in it

To calculate the required return for Stock A using the Capital Asset Pricing Model CAPM we need the ... View full answer

Get step-by-step solutions from verified subject matter experts