Question: Probability Probability Probability 1. The graph below provides a comparison of alternative techniques a US multinational company can use to hedge a receivable of

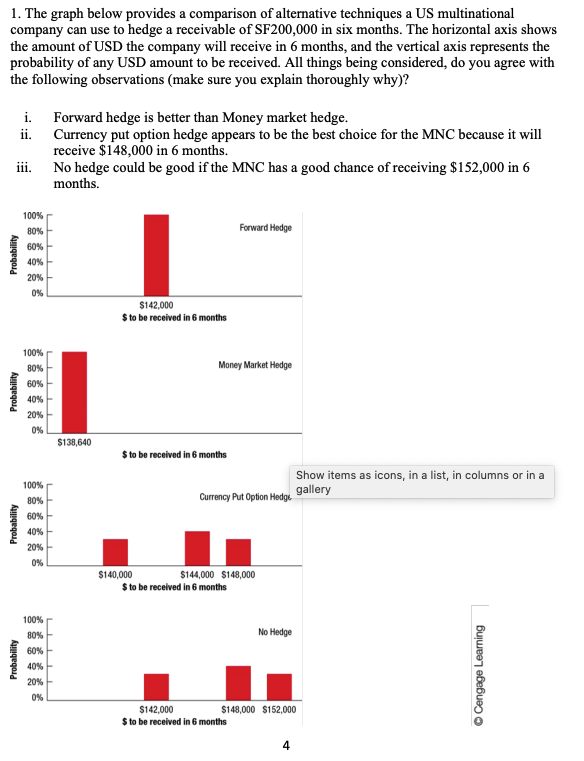

Probability Probability Probability 1. The graph below provides a comparison of alternative techniques a US multinational company can use to hedge a receivable of SF200,000 in six months. The horizontal axis shows the amount of USD the company will receive in 6 months, and the vertical axis represents the probability of any USD amount to be received. All things being considered, do you agree with the following observations (make sure you explain thoroughly why)? i. Forward hedge is better than Money market hedge. ii. iii. Currency put option hedge appears to be the best choice for the MNC because it will receive $148,000 in 6 months. No hedge could be good if the MNC has a good chance of receiving $152,000 in 6 months. 100% 80% 60% 40% 20% 0% 100% $142,000 $ to be received in 6 months Forward Hedge Money Market Hedge 80% 60% 40% 20% 0% $138,640 $ to be received in 6 months 100% 80% 60% 40% 20% 0% $140,000 100% 80% 60% 40% Probability 20% 0% $ to be received in 6 months Currency Put Option Hedge Show items as icons, in a list, in columns or in a gallery $144,000 $148,000 No Hedge $142,000 $148,000 $152,000 $ to be received in 6 months 4 Cengage Learning

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts