Question: Problem 0 5 - 4 0 ( LO 0 5 - 2 ) ( Algo ) Assume that on January 1 , year 1 ,

Problem LO Algo

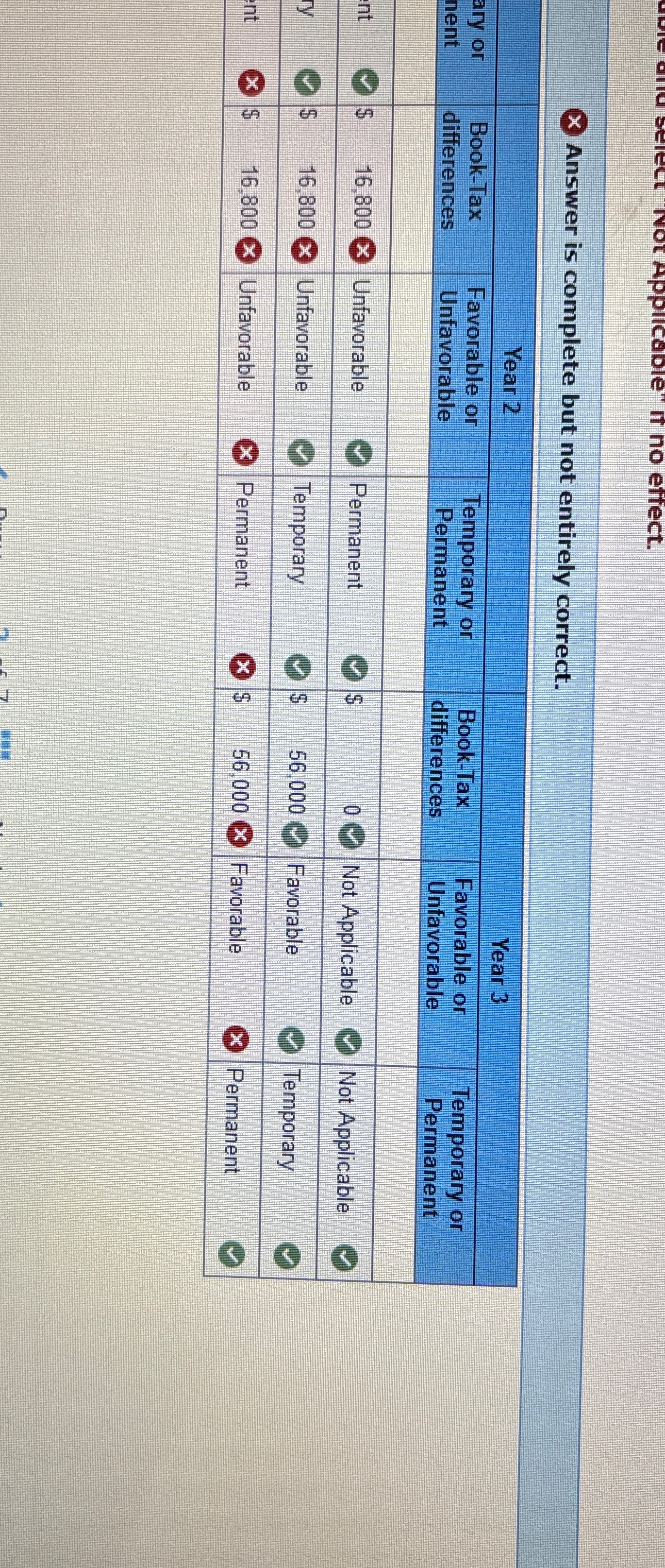

Assume that on January year ABC Incorporated issued stock options with an estimated value of $ per option. Each option entitles the owner to purchase one share of ABC stock for $ a share the per share price of ABC stock on January year when the options were granted The options vest at the end of the day on December year All stock options were exercised in year when the ABC stock was valued at $ per share. Identify ABC's year and tax deductions and booktax differences indicate as favorable or unfavorable and as permanent or temporary associated with the stock options under the following alternative scenarios:

Required:

a The stock options are incentive stock options.

b The stock options are nonqualified stock options.

Complete the following table.

Note: For all requirements, leave no answer blank. Enter zero if applicable and select "Not Applicable" if no effect.

Answer is complete but not entirely correct.

Year

Year

Prev

of

Next

nplete the following table.

For all requirements, leave no answer blank. Enter zero if applicable and select "Not Applicable" if no effect.

Answer is complete but not entirely correct.

Prev

of

Next

Answer is complete but not entirely correct.

tableYear Year tableokTaxarencestableFavorableUnfavorabtableTemporarPermanetableokTaxerencestableFavorable orUnfavorabletableTemporary orPermanentoUnfavorable,Permanent,$Not Applicable,Not Applicable,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock