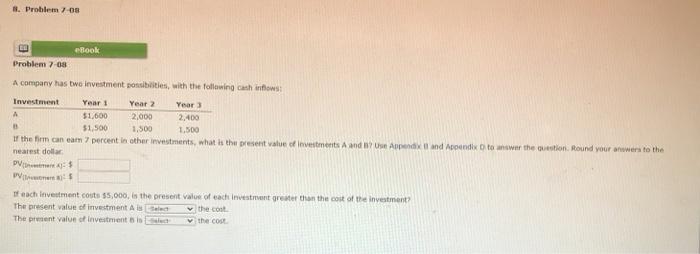

Question: . Problem -08 eBook Problem 7-08 A company has two investment possibilities, with the following cash flows Investment Year 1 Year 2 Year A $1,600

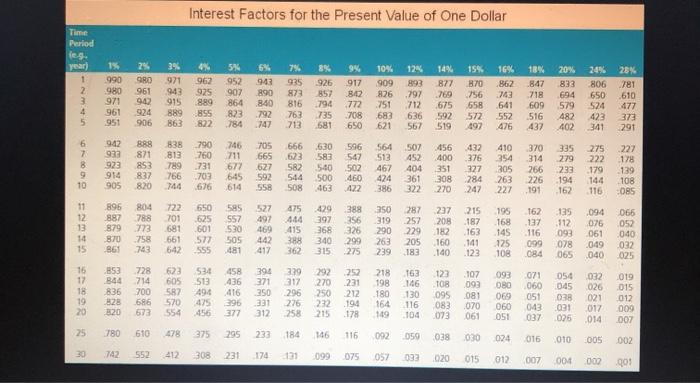

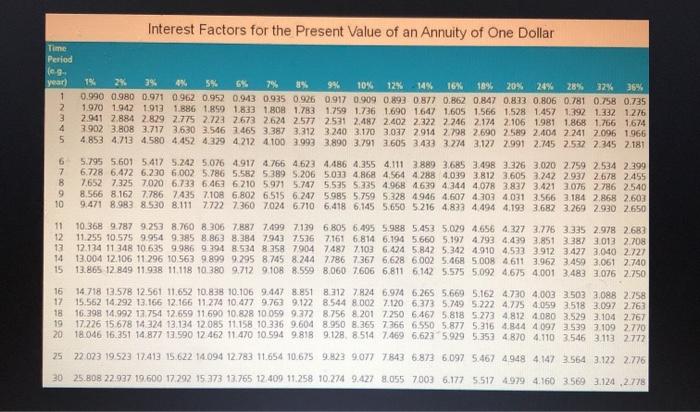

. Problem -08 eBook Problem 7-08 A company has two investment possibilities, with the following cash flows Investment Year 1 Year 2 Year A $1,600 2,000 2,400 $1,500 1,500 1,500 If the firm can earn percent in other investments, what is the present value of investments A and ? Use Appendy and Appendix to answer the question. Round your awwers to the nearest doll Vine : Viens If each investment couts 55,000, is the present value of each investment greater than the cost of the investment? The present value of investment Art y the cont The present value of investment is the cost Interest Factors for the Present Value of One Dollar 18 4 51 6% 159 16 18 Time Period les Year) 1 2 3 4 5 25 GRA 961 233 184 092 030 024 412 174 121 2099 057 033 015 012 Interest Factors for the Present Value of an Annuity of One Dollar Time Period year 1 2 3 4 5 1% 2% 3% 4X 5% 8 9% 10% 12% 14% 16% 20% 24% 28% 32% 36% 0.990 0.980 0.971 0962 0.952 0.943 0.935 0.926 0.917 0.909 0.893 0877 0.862 0.847 0.833 0.806 0.781 0.758 0.735 1970 1942 1913 1.886 1.859 1833 1808 1.783 1759 1.736 1.690 1647 1.605 1.566 1.528 1.457 1.392 1.332 1.276 2.9412.884 2.829 2.775 2.723 2.673 2624 2577 2531 2.487 2.402 2322 2.246 2174 2.106 1981 1.868 1.766 1674 3.902 3.808 3.717 3630 3.546 1.465 3.387 3.312 3.240 3.170 3.037 2.914 2.798 2.690 2589 2.404 2.241 2.096 1.966 4.853 4.713 4.580 4.452 4.329 4.212 4100 39933.890 3.791 2605 3.433 3.274 3.127 2.991 2.745 2.537 2.345 2181 5.795 5.601 5.417 5.242 5.076 4.917 4.766 4623 4486 4.355 4.111 3889 3.685 3.498 3.326 3.020 2.759 2.534 2399 6.728 6.472 6.230 6.002 5.786 5.582 5.389 5.206 5,033 4.868 4564 4288 4.039 3.812 3.605 3.242 2.937 2.678 2.455 7652 7,325 7020 6.733 6.463 6.210 5971 5.747 5.535 5.335 4.968 1639 4 344 4.078 3.837 3.421 3.075 2786 2540 8.566 8.162 7.786 7435 7.108 6.802 6515 6.2475985 5.759 5.328 4946 4,607 4.303 4031 3.566 3.184 2.868 2.603 9.471 8.983 8.530 8.111 7722 7.360 7024 6.710 6.418 6145 5.650 5216 4,833 4494 4.193 3.682 3.269 2.930 2.650 6 7 B 9 10 11 12 13 14 15 10.368 9.787 9.253 8.760 8 306 7.887 7.499 7.139 6 805 6.495 5.988 5.453 5.029 4.656 4.327 3.776 3 335 2.978 2.683 11.255 10.575 9.954 9.385 8.863 8.384 7943 75367.161 6.814 6.194 5.660 5.197 4.793 4.439 3.851 3387 3013 2.708 12.134 11 348 10 635 9.986 9794 8.534 8.358 7904 7487 7.103 6.424 5842 5.342 4.910 4,533 3.912 3.427 3.040 2.727 13.004 12.106 11 296 10.563 9.899 9.295 8.745 8.244 7.786 7367 6,628 6 002 5.468 5008 4611 3.962 3.459 3,061 2.740 13.865 12 849 11.938 11.118 10.380 9.712 9.108 8.559 8,060 7.606 6.811 6.142 5.575 5.092 4,675 4.001 3.483 3.076 2.750 16 14 718 13.578 12.561 11.652 10.838 10:1069.447 8.851 8 312 7824 6.974 6,265 5.669 5.162 4720 4,003 3.503 3.088 2.758 17 15.562 14.292 13.166 12.166 11 274 10.477 9763 9.122 8,544 8002 7.120 6.373 5.749 5.222 4775 4,059 3518 3.097 2.763 18 16.398 14,992 17.754 52.659 11 590 10.828 10 059 9.372 8.756 8.2017.250 6.467 5.818 5.273 4812 4080 3.529 3.104 2.767 19 17226 15 678 14 324 13.134 12.085 11.158 10 336 9.604 8.950 8.3657366 6.550 5.877 5.316 444 4 097 3539 3.109 2.770 2018.046 16.351 14.877 13.590 12.462 11.470 10.594 9.813 9.128 8514 7.469 6.623 5929 5353 48704.110 3546 3.113 2772 25 22.023 19.523 17.413 15.622 14.094 12.783 11.654 10.675 9.823 9.077 7.843 6873 6.097 5.462 4948 4.147 3 564 3.122 2.776 30 25.808 22.937 19.600 17.292 15 373 13.765 12.409 11.258 10.274 9.427 8.055 7003 6.177 5.517 4.9794.160 3569 3.124,2778

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts