Question: Problem 1 0 - 1 B Straight - Line: Amortization of bond discount ubrace ( u b r a c e ) P 2 Romero

Problem B StraightLine: Amortization of bond discount ubrace

Romero issues $ of year bonds dated January that pay interest semiannually on June and December The

bonds are issued at a price of $

Required

Prepare the January journal entry to record the bonds' issuance.

For each semiannual period, compute the cash payment, the straightline discount amortization, and the bond interest

expense.

Determine the total bond interest expense to be recognized over the bonds' life.

Prepare the first two years of a straightline amortization table like Exhibit

Prepare the journal entries to record the first two interest payments.

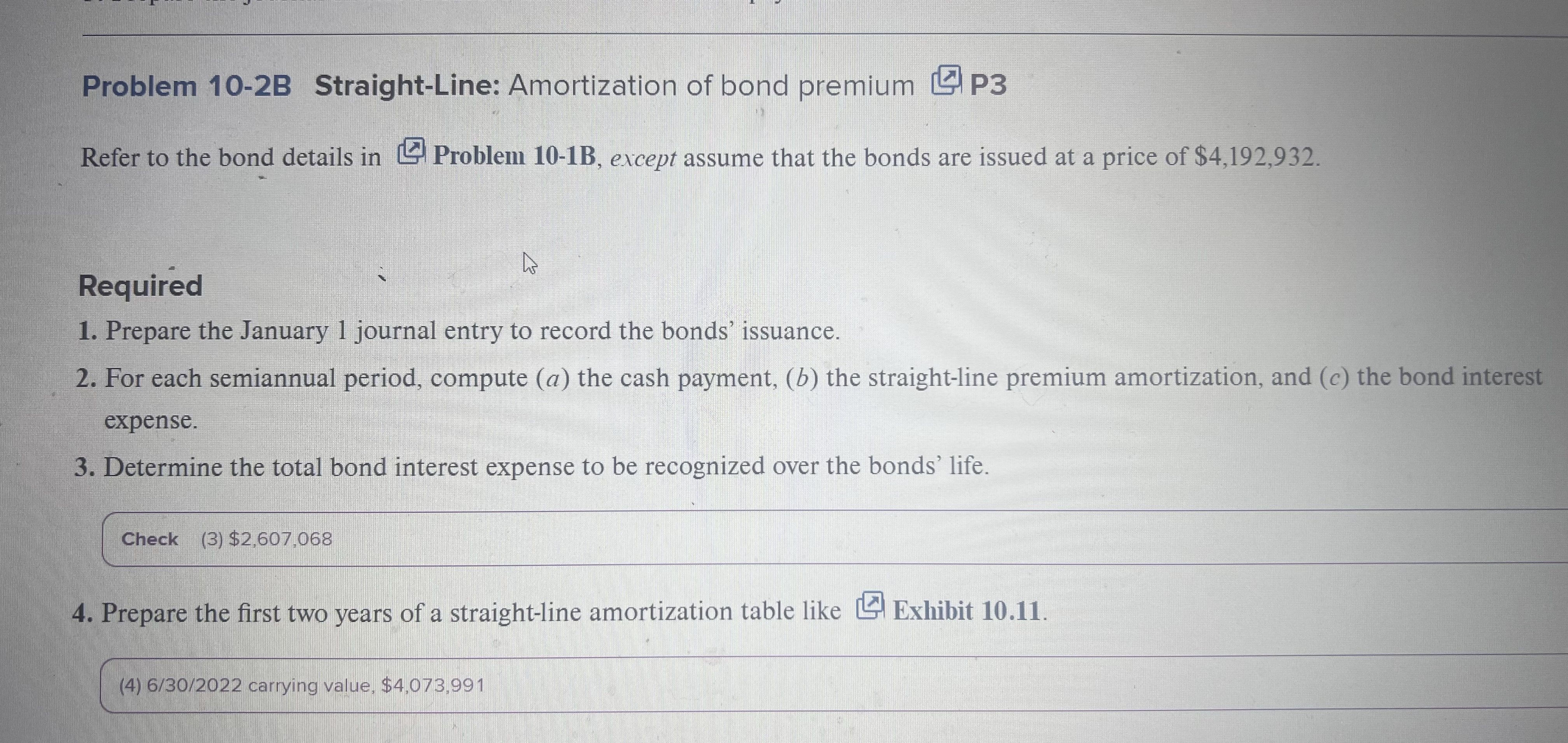

Problem B StraightLine: Amortization of bond premium

Problem B StraightLine: Amortization of bond premium P

Refer to the bond details in Problem B except assume that the bonds are issued at a price of $

Required

Prepare the January journal entry to record the bonds' issuance.

For each semiannual period, compute the cash payment, the straightline premium amortization, and the bond interest

expense.

Determine the total bond interest expense to be recognized over the bonds' life.

Check

$

Prepare the first two years of a straightline amortization table like Exhibit

carrying value, $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock