Question: Problem 1 0 - 2 5 Calculating a Bid Price [ LO 3 ] Consider a project to supply 1 0 0 million postage stamps

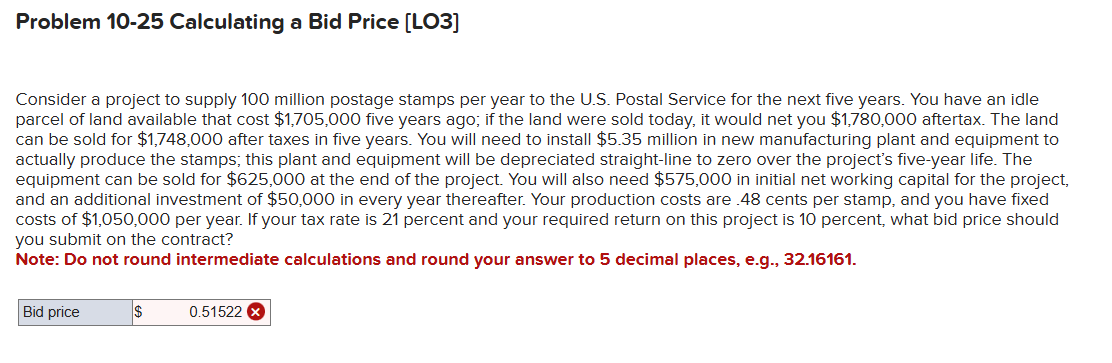

Problem Calculating a Bid Price LO Consider a project to supply million postage stamps per year to the US Postal Service for the next five years. You have an idle parcel of land available that cost $ five years ago; if the land were sold today, it would net you $ aftertax. The land can be sold for $ after taxes in five years. You will need to install $ million in new manufacturing plant and equipment to actually produce the stamps; this plant and equipment will be depreciated straightline to zero over the project's fiveyear life. The equipment can be sold for $ at the end of the project. You will also need $ in initial net working capital for the project, and an additional investment of $ in every year thereafter. Your production costs are cents per stamp, and you have fixed costs of $ per year. If your tax rate is percent and your required return on this project is percent, what bid price should you submit on the contract? Note: Do not round intermediate calculations and round your answer to decimal places, eg Bid price Problem Calculating a Bid Price LO

Consider a project to supply million postage stamps per year to the US Postal Service for the next five years. You have an idle parcel of land available that cost $ five years ago; if the land were sold today, it would net you $ aftertax. The land can be sold for $ after taxes in five years. You will need to install $ million in new manufacturing plant and equipment to actually produce the stamps; this plant and equipment will be depreciated straightline to zero over the project's fiveyear life. The equipment can be sold for $ at the end of the project. You will also need $ in initial net working capital for the project, and an additional investment of $ in every year thereafter. Your production costs are cents per stamp, and you have fixed costs of $ per year. If your tax rate is percent and your required return on this project is percent, what bid price should you submit on the contract?

Note: Do not round intermediate calculations and round your answer to decimal places, eg

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock