Question: Problem 1 0 . 2 A ( Algo ) Computing gross earnings, determining deductions, preparing payroll register, journalizing payroll transactions. LO 1 0 - 2

Problem A Algo Computing gross earnings, determining deductions, preparing payroll register, journalizing payroll transactions. LO

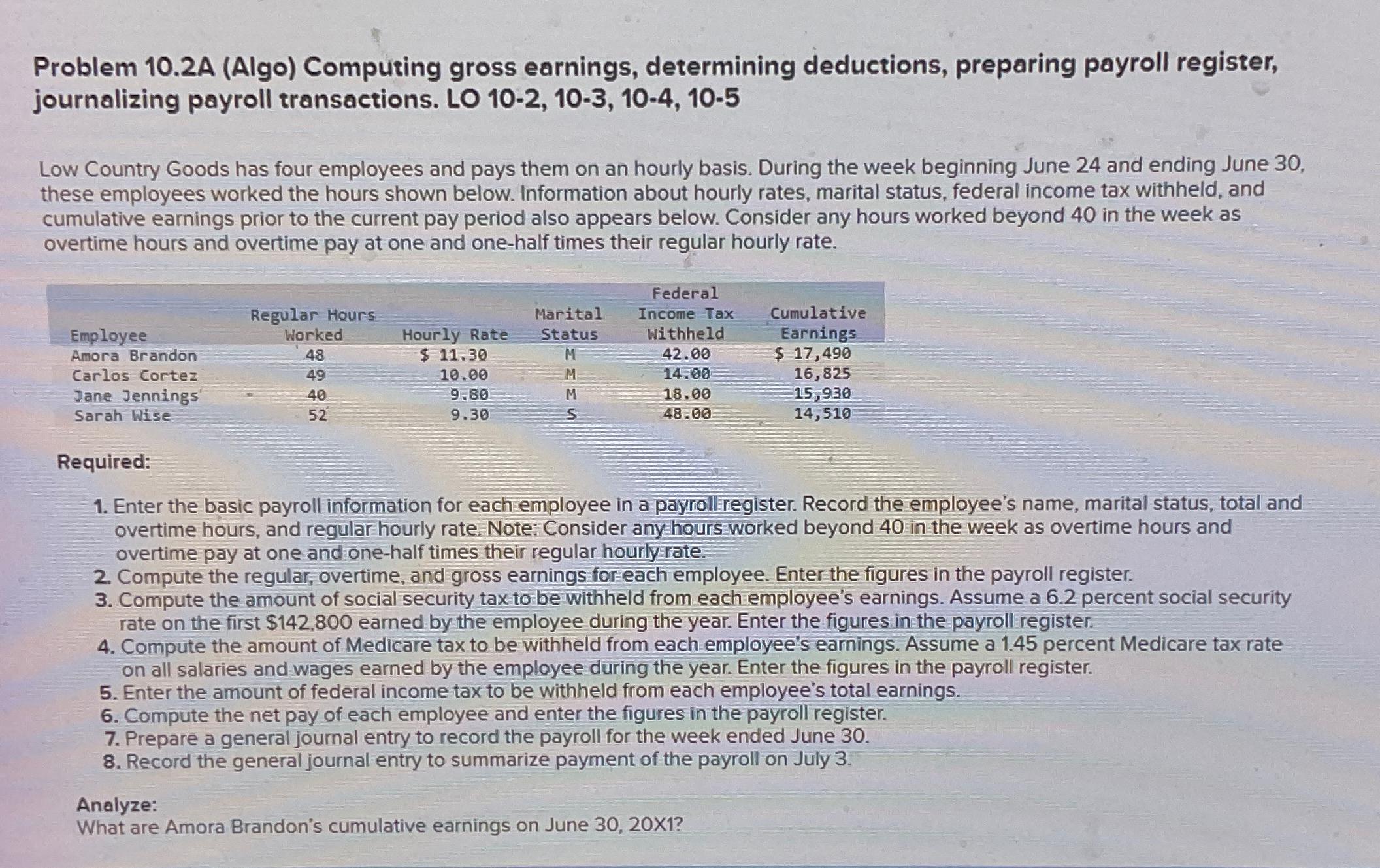

Low Country Goods has four employees and pays them on an hourly basis. During the week beginning June and ending June these employees worked the hours shown below. Information about hourly rates, marital status, federal income tax withheld, and cumulative earnings prior to the current pay period also appears below. Consider any hours worked beyond in the week as overtime hours and overtime pay at one and onehalf times their regular hourly rate.

Required:

Enter the basic payroll information for each employee in a payroll register. Record the employee's name, marital status, total and overtime hours, and regular hourly rate. Note: Consider any hours worked beyond in the week as overtime hours and overtime pay at one and onehalf times their regular hourly rate.

Compute the regular, overtime, and gross earnings for each employee. Enter the figures in the payroll register.

Compute the amount of social security tax to be withheld from each employee's earnings. Assume a percent social security rate on the first $ earned by the employee during the year. Enter the figures in the payroll register.

Compute the amount of Medicare tax to be withheld from each employee's earnings. Assume a percent Medicare tax rate on all salaries and wages earned by the employee during the year. Enter the figures in the payroll register.

Enter the amount of federal income tax to be withheld from each employee's total earnings.

Compute the net pay of each employee and enter the figures in the payroll register.

Prepare a general journal entry to record the payroll for the week ended June

Record the general journal entry to summarize payment of the payroll on July

Analyze:

What are Amora Brandon's cumulative earnings on June X

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock