Question: Problem 1 0 - 3 0 ( LO . 4 ) Nichole, who is single and uses the cash method of accounting, lives in a

Problem LO

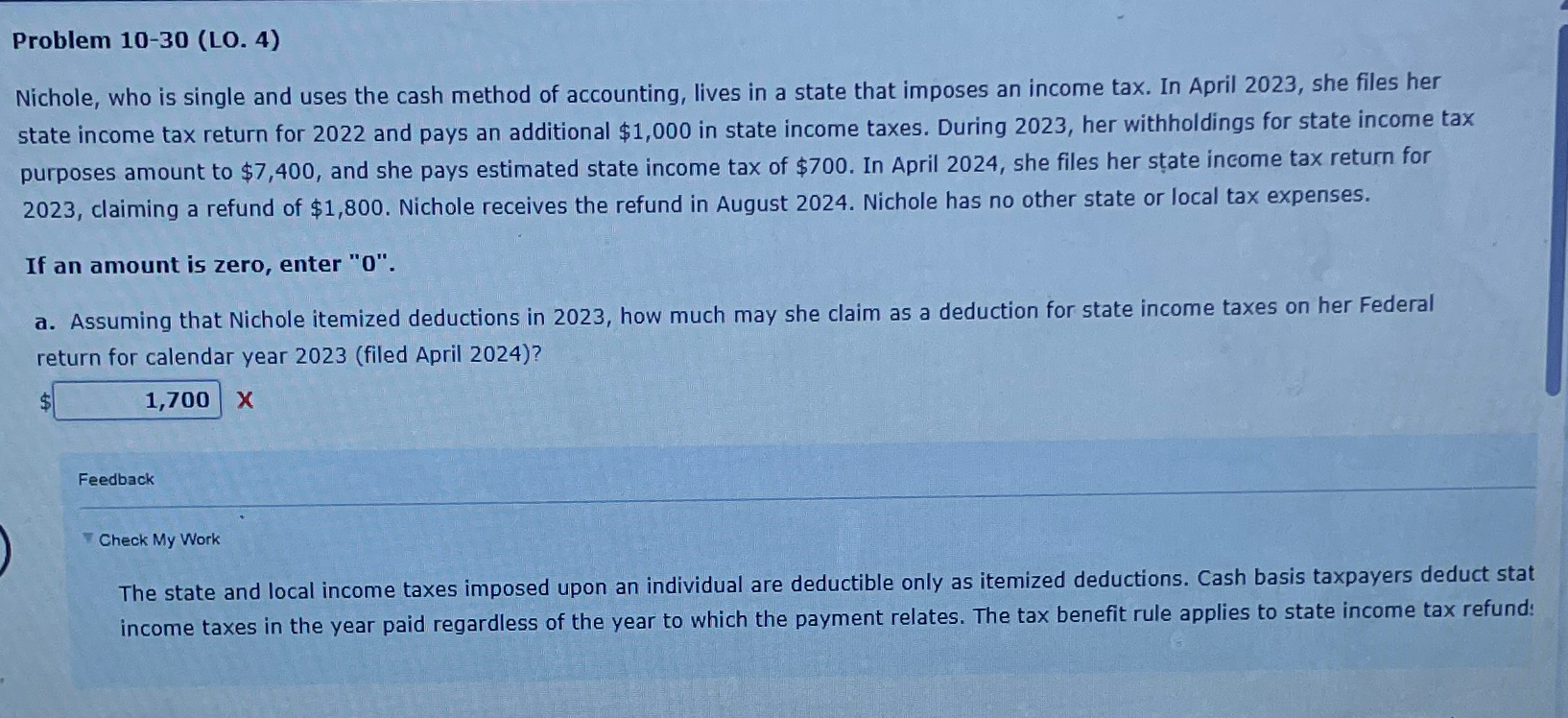

Nichole, who is single and uses the cash method of accounting, lives in a state that imposes an income tax. In April she files her state income tax return for and pays an additional $ in state income taxes. During her withholdings for state income tax purposes amount to $ and she pays estimated state income tax of $ In April she files her state income tax return for claiming a refund of $ Nichole receives the refund in August Nichole has no other state or local tax expenses.

If an amount is zero, enter

a Assuming that Nichole itemized deductions in how much may she claim as a deduction for state income taxes on her Federal return for calendar year filed April

Feedback

Check My Work

The state and local income taxes imposed upon an individual are deductible only as itemized deductions. Cash basis taxpayers deduct stat income taxes in the year paid regardless of the year to which the payment relates. The tax benefit rule applies to state income tax refund:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock