Question: Problem 1 0 - 3 A ( Algo ) Asset cost allocation; straight - line depreciation LO C 1 , P 1 [ The following

Problem A Algo Asset cost allocation; straightline depreciation LO C P

The following information applies to the questions displayed below.

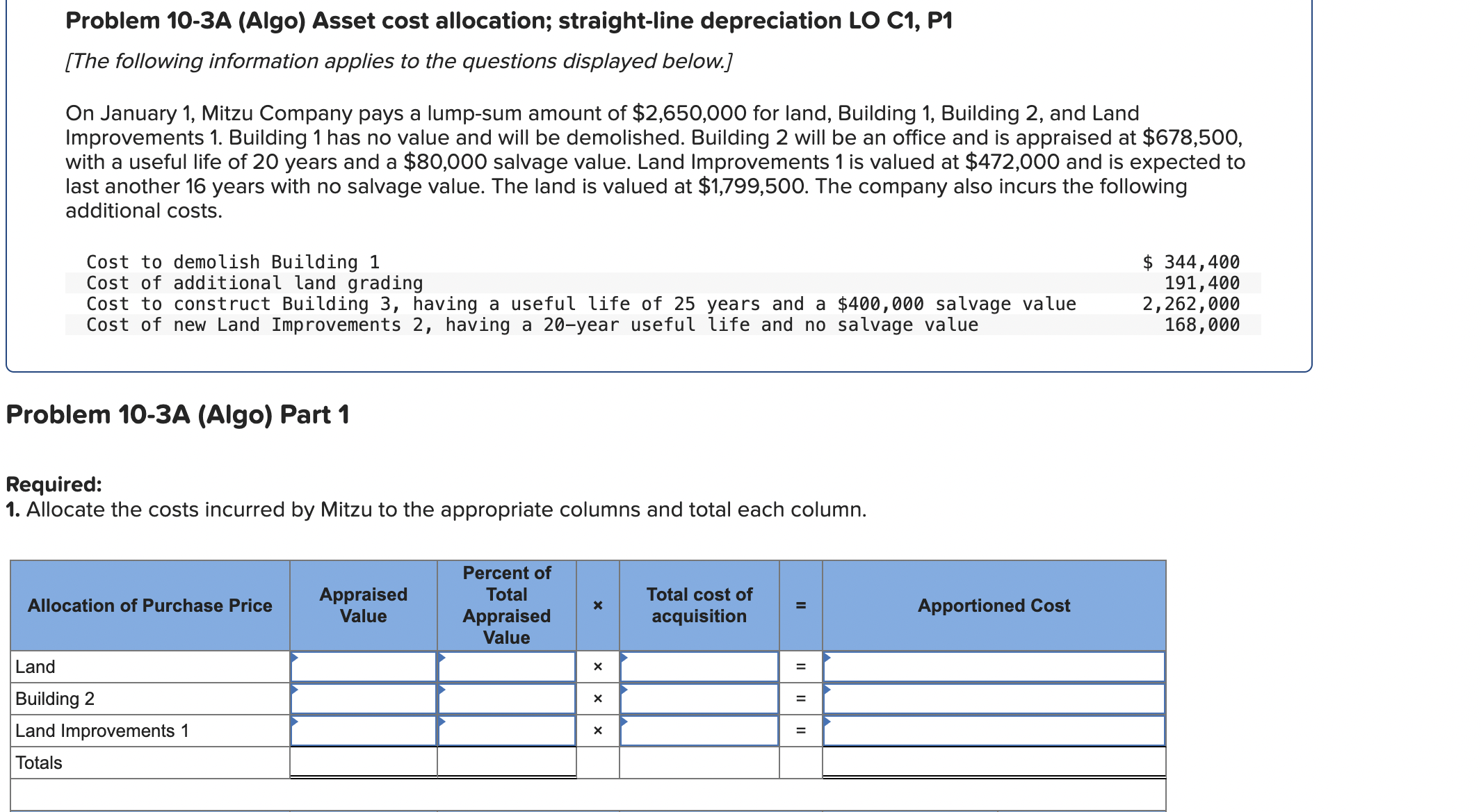

On January Mitzu Company pays a lumpsum amount of $ for land, Building Building and Land Improvements Building has no value and will be demolished. Building will be an office and is appraised at $ with a useful life of years and a $ salvage value. Land Improvements is valued at $ and is expected to last another years with no salvage value. The land is valued at $ The company also incurs the following additional costs.

Cost to demolish Building

Cost of additional land grading

Cost to construct Building having a useful life of years and a $ salvage value

Cost of new Land Improvements having a year useful life and no salvage value

$

Problem A Algo Part

Required:

Allocate the costs incurred by Mitzu to the appropriate columns and total each column. begintabularllllll

hline & multicolumnc Land & Building & Building & begintabularc

Land

Improvements

endtabular & begintabularc

Lmprovements

endtabular

hline Purchase Price & & & & &

hline Demolition & & & & &

hline Land grading & & & & &

hline New building Construction cost & & & & &

hline New improvements & & & & &

hline Totals & & & &

hline

endtabular Journal entry worksheet

Record the cost of the plant assets, paid in cash.

Note: Enter debits before credits.

Record the yearend adjusting entry for the depreciation expense of Land Improvements

Note: Enter debits before credits.

Record the yearend adjusting entry for the depreciation expense of Land Improvements

Note: Enter debits before credits.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock