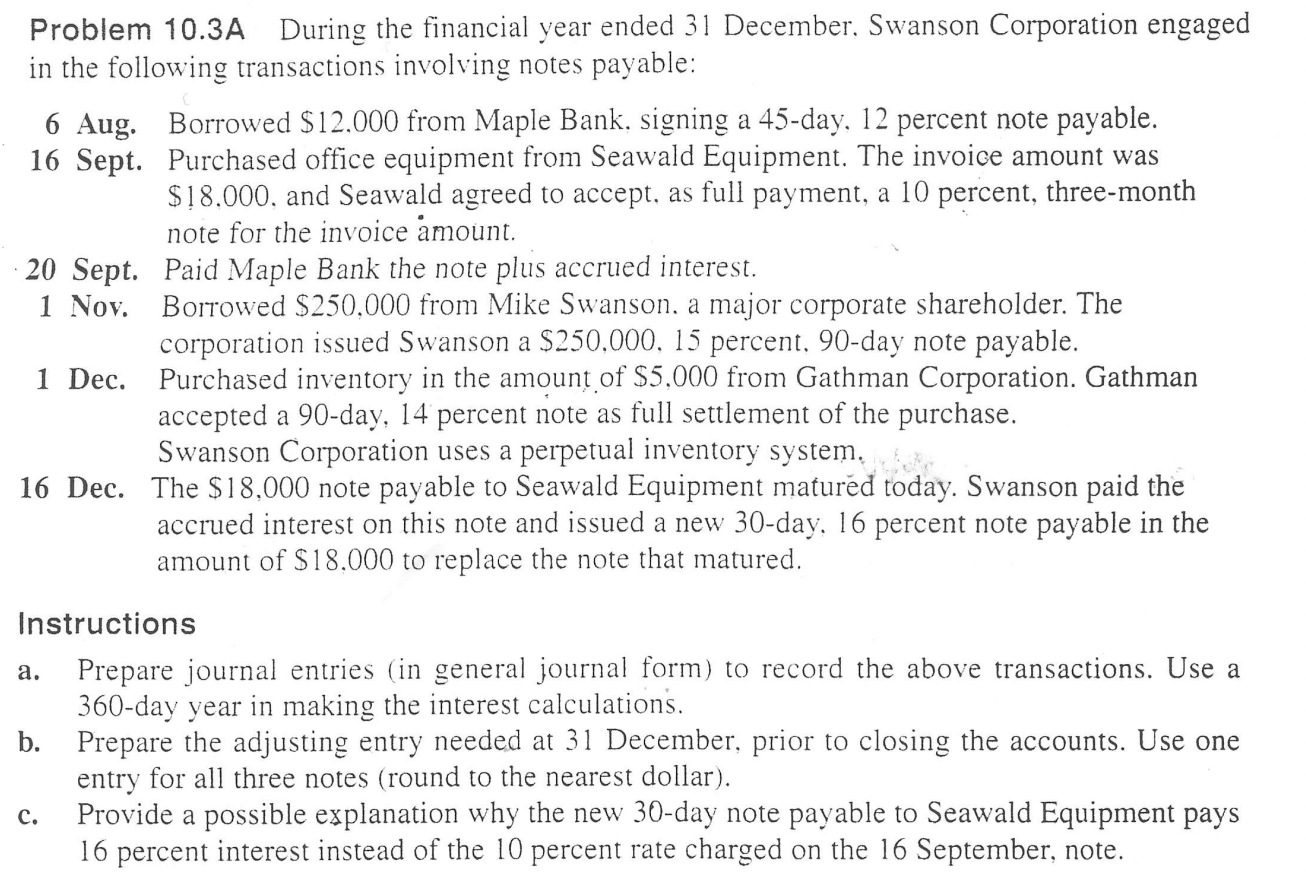

Question: Problem 1 0 . 3 A During the financial year ended 3 1 December. Swanson Corporation engaged in the following transactions involving notes payable: 6

Problem A During the financial year ended December. Swanson Corporation engaged in the following transactions involving notes payable:

Aug. Borrowed $ from Maple Bank, signing a day, percent note payable.

Sept. Purchased office equipment from Seawald Equipment. The invoice amount was $ and Seawald agreed to accept. as full payment, a percent, threemonth note for the invoice amount.

Sept. Paid Maple Bank the note plus accrued interest.

Nov. Borrowed $ from Mike Swanson. a major corporate shareholder. The corporation issued Swanson a $ percent, day note payable.

Dec. Purchased inventory in the amount of $ from Gathman Corporation. Gathman accepted a day, percent note as full settlement of the purchase. Swanson Corporation uses a perpetual inventory system.

Dec. The $ note payable to Seawald Equipment matured today. Swanson paid the accrued interest on this note and issued a new day, percent note payable in the amount of $ to replace the note that matured.

Instructions

a Prepare journal entries in general journal form to record the above transactions. Use a day year in making the interest calculations.

b Prepare the adjusting entry needed at December, prior to closing the accounts. Use one entry for all three notes round to the nearest dollar

c Provide a possible explanation why the new day note payable to Seawald Equipment pays percent interest instead of the percent rate charged on the September, note.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock