Question: Problem 1 0 - 3 ( LO 3 , 5 ) Income statement effects of transactions, 5 9 2 commitments, and hedging. Clayton Industries sells

Problem LO Income statement effects of transactions,

commitments, and hedging.

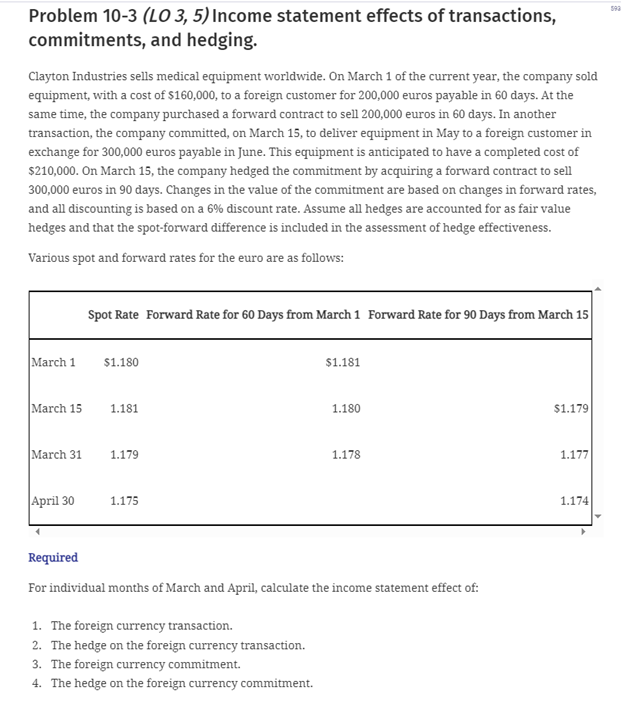

Clayton Industries sells medical equipment worldwide. On March of the current year, the company sold equipment, with a cost of $ to a foreign customer for euros payable in days. At the same time, the company purchased a forward contract to sell euros in days. In another transaction, the company committed, on March to deliver equipment in May to a foreign customer in exchange for euros payable in June. This equipment is anticipated to have a completed cost of $ On March the company hedged the commitment by acquiring a forward contract to sell euros in days. Changes in the value of the commitment are based on changes in forward rates, and all discounting is based on a discount rate. Assume all hedges are accounted for as fair value hedges and that the spotforward difference is included in the assessment of hedge effectiveness.

Various spot and forward rates for the euro are as follows:

begintabularllll

hline & Spot Rate Forward Rate for Days from March & Forward Rate for Days from March

March Spot Rate$ Forward Rate for days from March $

March Spot Rate Forward Rate for days from March Forward Rate for Days from March $

March Spot Rate Forward Rate for days from March Forward Rate for Days from March

April Spot Rate Forward Rate for Days from March

Required

For individual months of March and April, calculate the income statement effect of:

The foreign currency transaction.

The hedge on the foreign currency transaction.

The foreign currency commitment.

The hedge on the foreign currency commitment.

Please show all work for calculations

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock