Question: Problem 1 0 - 5 2 ( LO 1 0 - 2 ) ( Static ) Skip to question [ The following information applies to

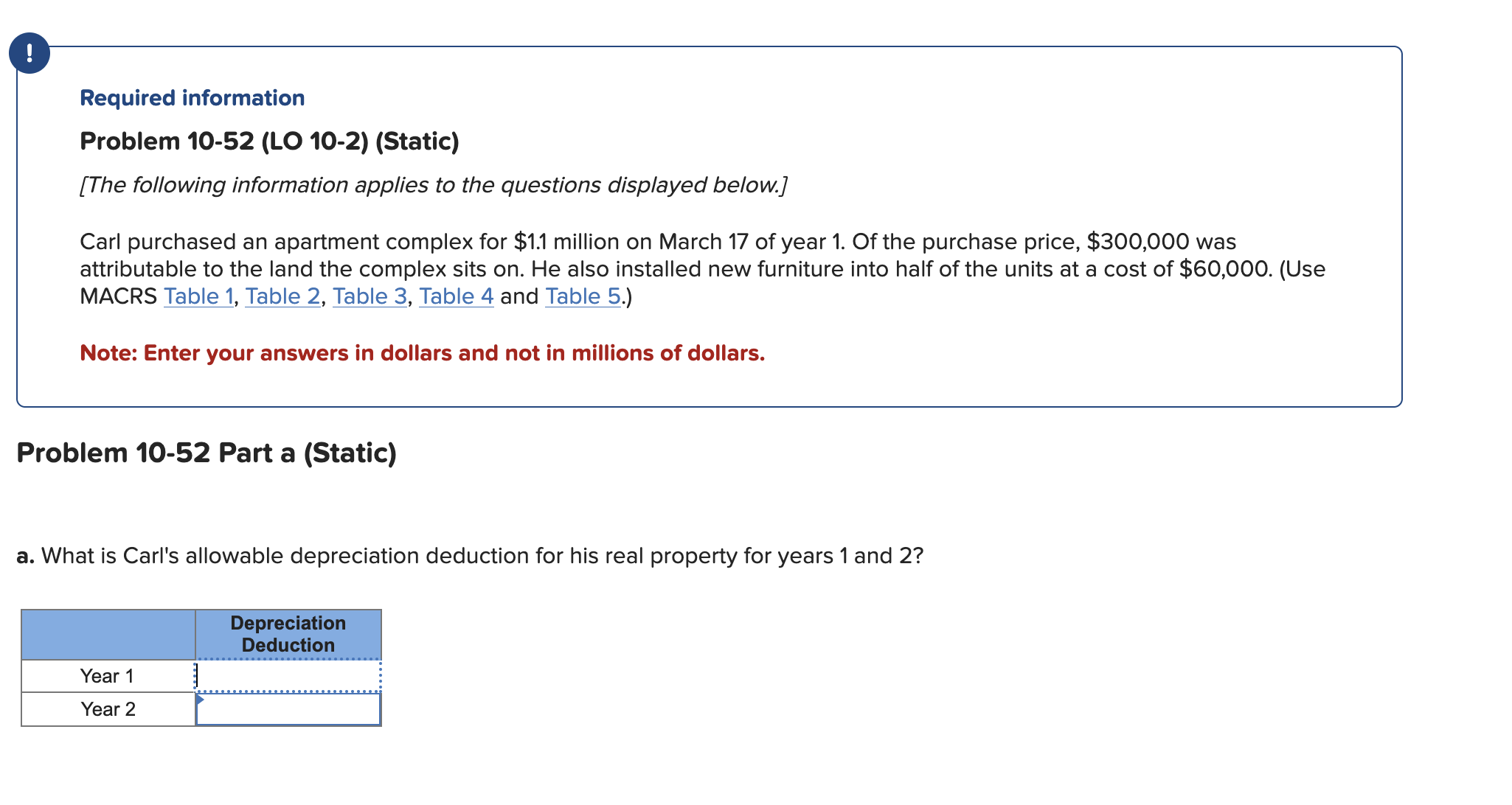

Problem LO Static Skip to question The following information applies to the questions displayed below. Carl purchased an apartment complex for $ million on March of year Of the purchase price, $ was attributable to the land the complex sits on He also installed new furniture into half of the units at a cost of $Use MACRS Table Table Table Table and Table Note: Enter your answers in dollars and not in millions of dollars. Problem Part a Static a What is Carl's allowable depreciation deduction for his real property for years and Required information Problem LO StaticThe following information applies to the questions displayed below. Carl purchased an apartment complex for $ million on March of year Of the purchase price, $ was attributable to the land the complex sits on He also installed new furniture into half of the units at a cost of $Use MACRS Table Table Table Table and Table Note: Enter your answers in dollars and not in millions of dollars. Problem Part a Static a What is Carl's allowable depreciation deduction for his real property for years and

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock