Question: Problem ( 1 0 points ) . Lucca Company is considering the purchase of a die cutting machine costing $ 1 0 0 , 0

Problem points

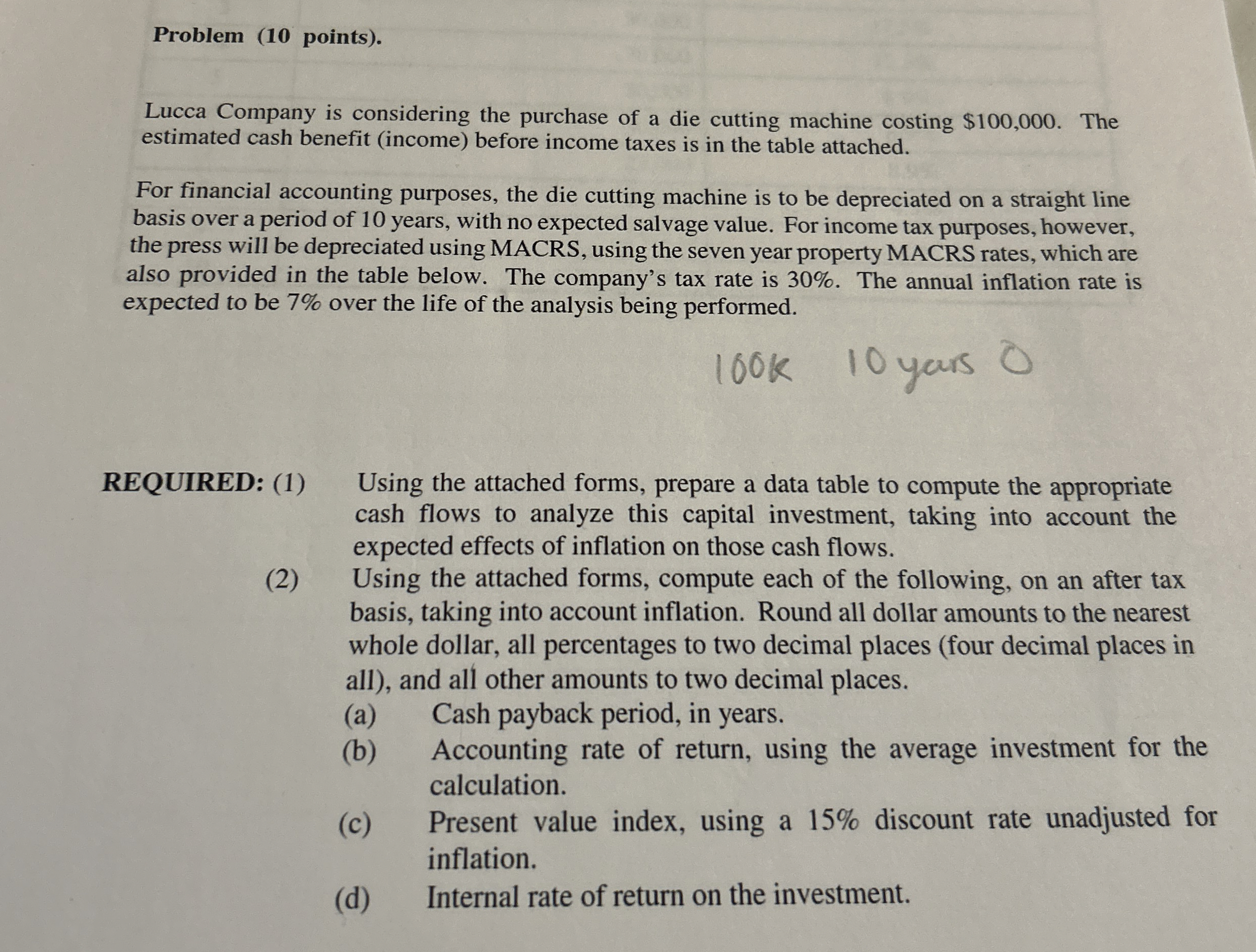

Lucca Company is considering the purchase of a die cutting machine costing $ The estimated cash benefit income before income taxes is in the table attached.

For financial accounting purposes, the die cutting machine is to be depreciated on a straight line basis over a period of years, with no expected salvage value. For income tax purposes, however, the press will be depreciated using MACRS, using the seven year property MACRS rates, which are also provided in the table below. The company's tax rate is The annual inflation rate is expected to be over the life of the analysis being performed.

k

yars

REQUIRED: Using the attached forms, prepare a data table to compute the appropriate cash flows to analyze this capital investment, taking into account the expected effects of inflation on those cash flows.

Using the attached forms, compute each of the following, on an after tax basis, taking into account inflation. Round all dollar amounts to the nearest whole dollar, all percentages to two decimal places four decimal places in all and all other amounts to two decimal places.

a Cash payback period, in years.

b Accounting rate of return, using the average investment for the calculation.

c Present value index, using a discount rate unadjusted for inflation.

d Internal rate of return on the investment.

Year cash benefit Macrs depreciation rate

Year cash benefit macrs depreciation rate

Year cash benefit macrs depreciation for year

Macrs depreciation for year

Macrs depreciation for year

year Cash benefit macrs depreciation

Year cash benefit macrs depreciation rate

Year cash benefit no macrs depreciation

Year cash benefit no macrs depreciation

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock