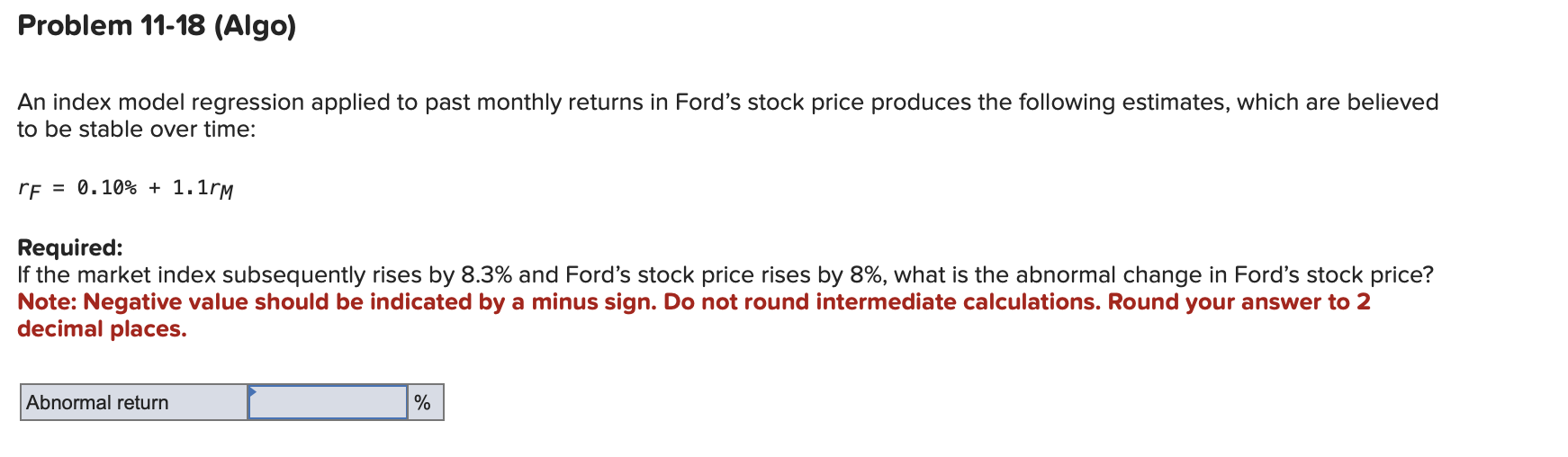

Question: Problem 1 1 - 1 8 ( Algo ) An index model regression applied to past monthly returns in Ford's stock price produces the following

Problem Algo An index model regression applied to past monthly returns in Ford's stock price produces the following estimates, which are believed to be stable over time: rF rM Required: If the market index subsequently rises by and Ford's stock price rises by what is the abnormal change in Ford's stock price? Note: Negative value should be indicated by a minus sign. Do not round intermediate calculations. Round your answer to decimal places. Abnormal return

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock