Question: Problem 1 1 - 2 2 ( Algo ) You manage a pension fund that will provide retired workers with lifetime annuities. You determine that

Problem Algo

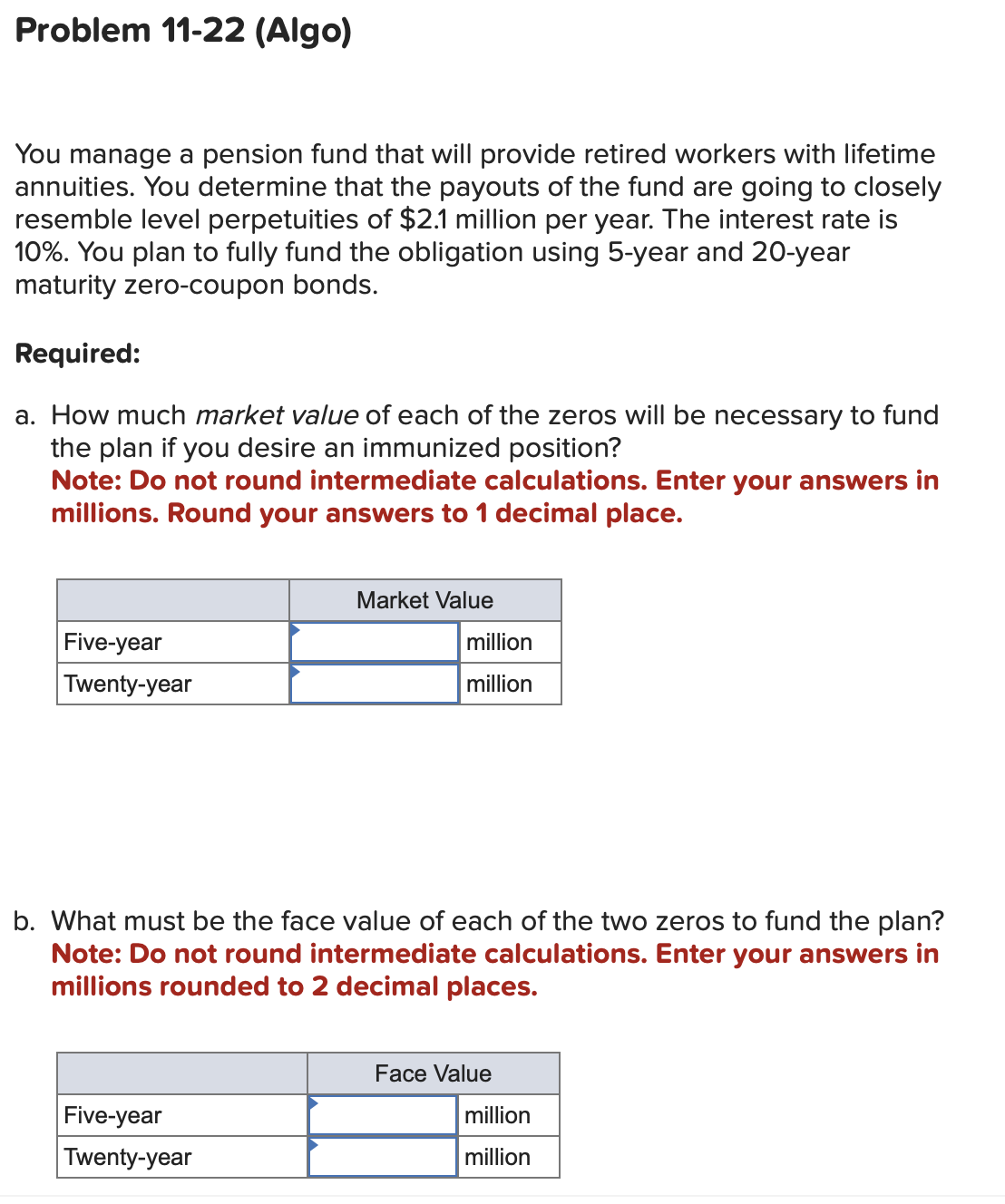

You manage a pension fund that will provide retired workers with lifetime

annuities. You determine that the payouts of the fund are going to closely

resemble level perpetuities of $ million per year. The interest rate is

You plan to fully fund the obligation using year and year

maturity zerocoupon bonds.

Required:

a How much market value of each of the zeros will be necessary to fund

the plan if you desire an immunized position?

Note: Do not round intermediate calculations. Enter your answers in

millions. Round your answers to decimal place.

b What must be the face value of each of the two zeros to fund the plan?

Note: Do not round intermediate calculations. Enter your answers in

millions rounded to decimal places.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock