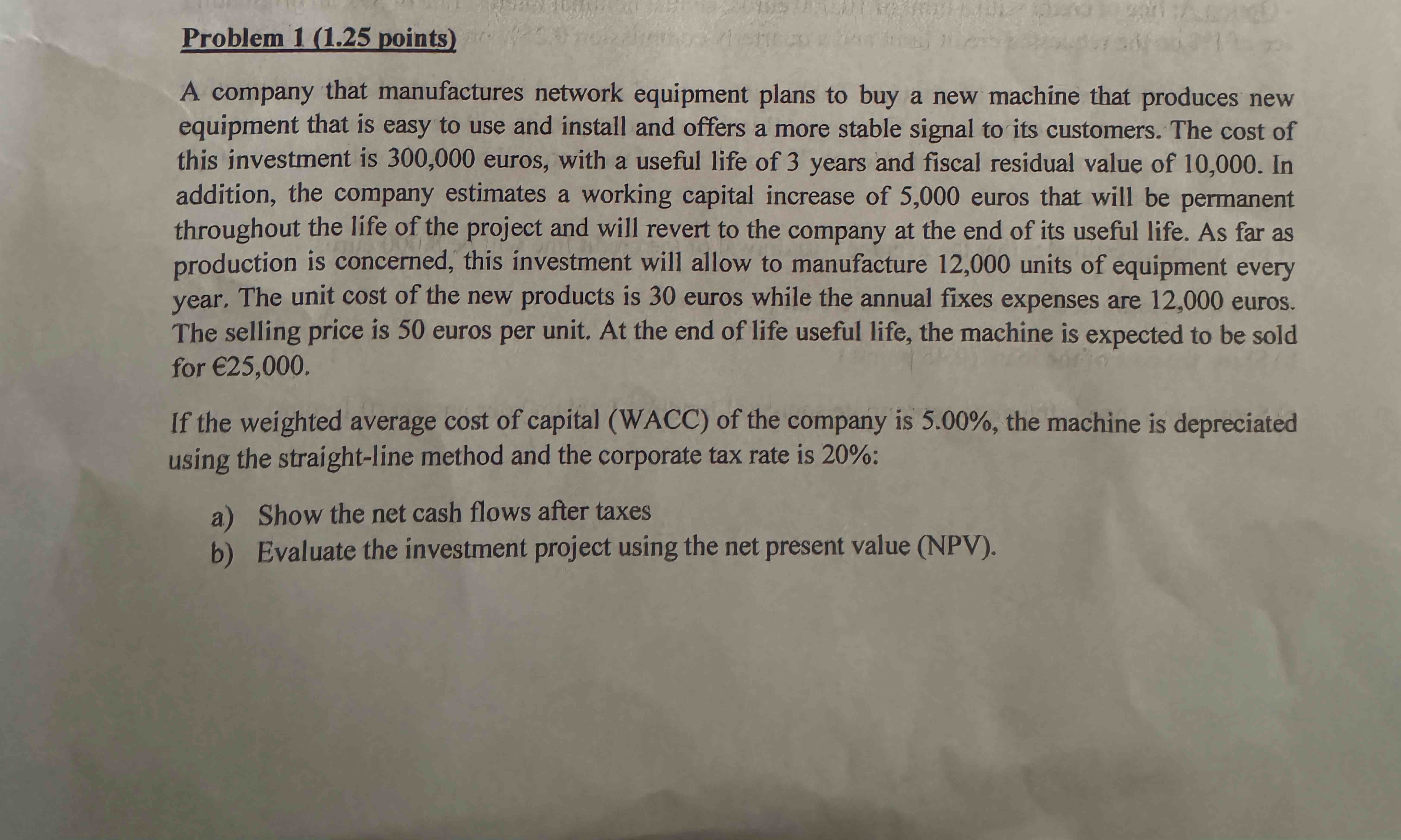

Question: Problem 1 ( 1 . 2 5 points ) A company that manufactures network equipment plans to buy a new machine that produces new equipment

Problem points A company that manufactures network equipment plans to buy a new machine that produces new equipment that is easy to use and install and offers a more stable signal to its customers. The cost of this investment is euros, with a useful life of years and fiscal residual value of In addition, the company estimates a working capital increase of euros that will be permanent throughout the life of the project and will revert to the company at the end of its useful life. As far as production is concerned, this investment will allow to manufacture units of equipment every year. The unit cost of the new products is euros while the annual fixes expenses are euros. The selling price is euros per unit. At the end of life useful life, the machine is expected to be sold for If the weighted average cost of capital WACC of the company is the machine is depreciated using the straightline method and the corporate tax rate is : a Show the net cash flows after taxes b Evaluate the investment project using the net present value NPV

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock