Question: Problem 1 1 - 3 3 Systematic versus Unsystematic Risk Consider the following information about Stocks I and II: table [ [ ,

Problem Systematic versus Unsystematic Risk

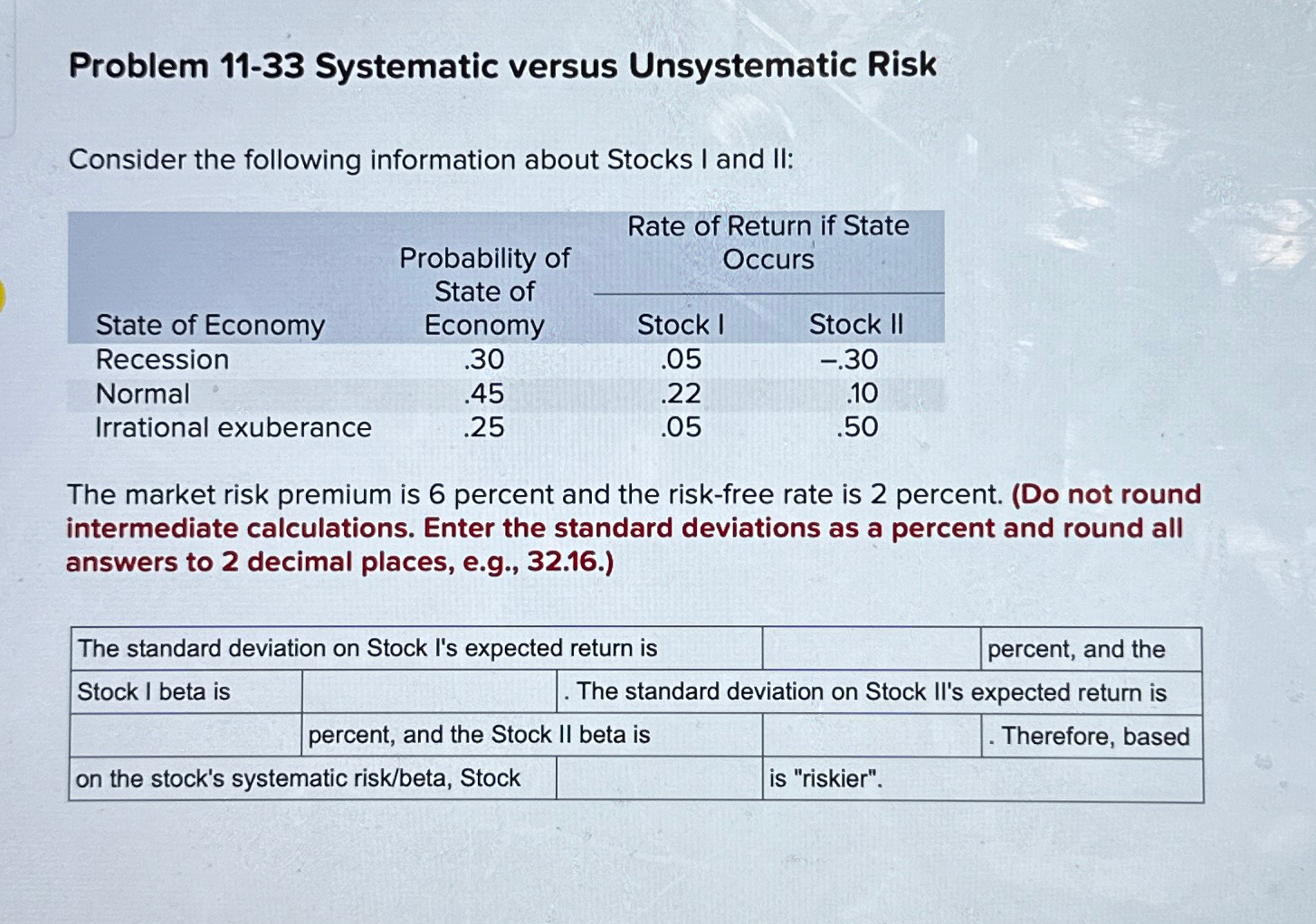

Consider the following information about Stocks I and II:

tabletableProbability ofState oftableRate of Return if StateOccursState of Economy,Economy,Stock I,Stock IIRecessionNormalIrrational exuberance,

The market risk premium is percent and the riskfree rate is percent. Do not round intermediate calculations. Enter the standard deviations as a percent and round all answers to decimal places, eg

tableThe standard deviation on Stock Is expected return ispercent, and the,Stock I beta is The standard deviation on Stock II's expected return ispercent, and the Stock II beta is Therefore, basedon the stock's systematic riskbeta Stock,,is "riskier".,

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock