Question: Problem 1 1 - 5 5 ( LO 1 1 - 2 ) Ken is a self - employed architect in a small firm with

Problem LO

Ken is a selfemployed architect in a small firm with four employees: himself, his office assistant, and two drafters, all of whom has worked for Ken fulltime for the last four years. The office assistant earns $ per year, and each drafter earns $ Ken' earnings from selfemployment after deducting all expenses and onehalf of selfemployment taxes are $ Ken is consid whether to establish a SEP plan and has a few questions. Assume that all the employees are at least years old.

Required:

a Is he eligible to establish a SEP plan?

Prev

of

Neat

ok

nt

rences

b Is he required to cover his employees under the plan?

Prev

of

Negrt

Search

c If his employees must be covered, what is the maximum amount that can be contributed on their behalf?

Book

Lesser of $ or of employee earnings

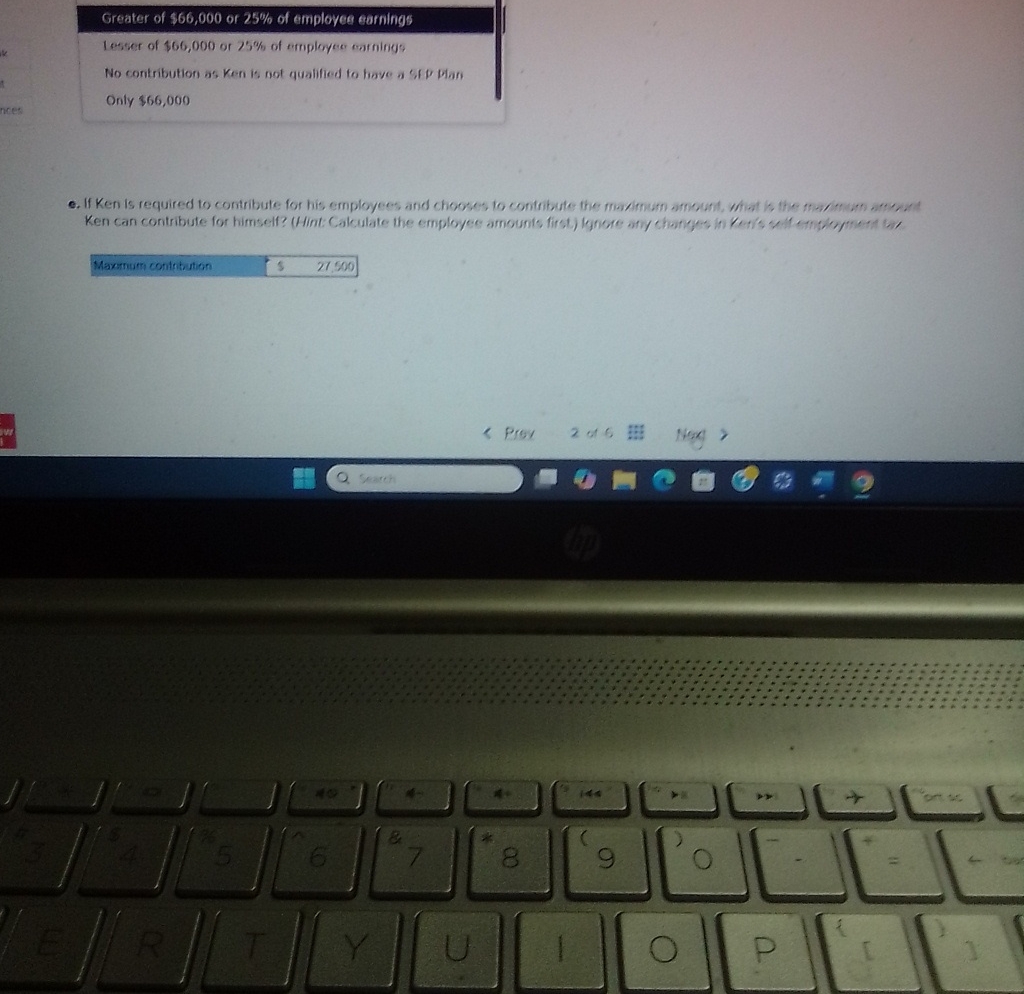

d If the employees are not covered, what is the maximum amount Ken can contribute for himself?

Prev

of

Next

Search

Greater of $ or of employes earnings

lesser of $ or of employee earnings

No contribution as Ken is not qualified to have a sip Man

Only $

Maxminen contritution

Pros

at

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock