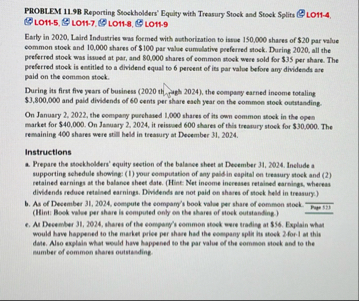

Question: PROBLEM 1 1 . 9 B Reporting Stockholders' Equity with Treasury Stork and Stoek Splits SO 1 1 - 4 , ( 8 ) LO

PROBLEM B Reporting Stockholders' Equity with Treasury Stork and Stoek Splits SO LO LOH LO LO

Early in Laird Industries was formed with asthorization to ismee shares of $ par value common stoek and shares of $ par value cumulative peeferred stock. During all the peeferred stock was lisued at par, and shares of common stock were sold for $ per share. The peeferred stock is entitled to a dividend equal to persent of ies par valoe before any dividenda are paid on the common stock.

During its firs five years of business th yagh the company earned income totaling $ and paid dividends of eents per share each year on the common stock outtitanding.

On January the eompary perchased shares of its own common atock in the open market for $ On January it reiswoed ahares of this treanury stook for $ The remaining shares were still held in treaury at December

Instructions

a Prepare the stoskholders' equity sevtion of the balasee sheet at Deeember Include a supporting schedule showing: your computation of any paid in eapital en treasury stock and retained earnings at the balance sheet date. Hint: Net income increases retaised earnings, whereas dividends refuce retalued earnings. Dividends we not paid on shares of stock hald in treasury.

b As of Desember eompute the compan's book valae per share of eommon noek. Hint: Book veles per share is computed only os the shares of stock eutstanding.

A December shares of the sompary's common stoek evee trading at $ Explain what would have happened to the market pries per shase had the eompany splin its atook For at this date. Also explais what wevid have happened to the par value of the common stoek and to the number of sommon shares outstasding.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock