Question: Problem 1 (10) A machine currently in use was bought five years ago for $4,000. Now it can be sold for $2,500, but could be

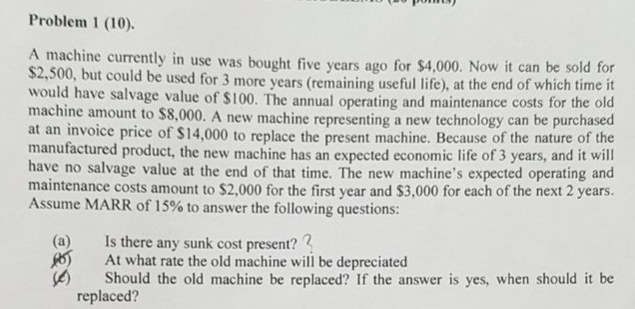

Problem 1 (10) A machine currently in use was bought five years ago for $4,000. Now it can be sold for $2,500, but could be used for 3 more years (remaining useful life), at the end of which time it would have salvage value of $100. The annual operating and maintenance costs for the old machine amount to $8,000. A new machine representing a new technology can be purchased at an invoice price of $14,000 to replace the present machine. Because of the nature of the manufactured product, the new machine has an expected economic life of 3 years, and it will have no salvage value at the end of that time. The new machine's expected operating and maintenance costs amount to $2,000 for the first year and $3,000 for each of the next 2 years. Assume MARR of 15% to answer the following questions: (a) Is there any sunk cost present?? At what rate the old machine will be depreciated Should the old machine be replaced? If the answer is yes, when should it be replaced

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts