Question: PROBLEM 1 (10 points: 2 points for each part) An unlevered (all-equity) firm has 360,000 common shares trading at $50 per share. With its investment

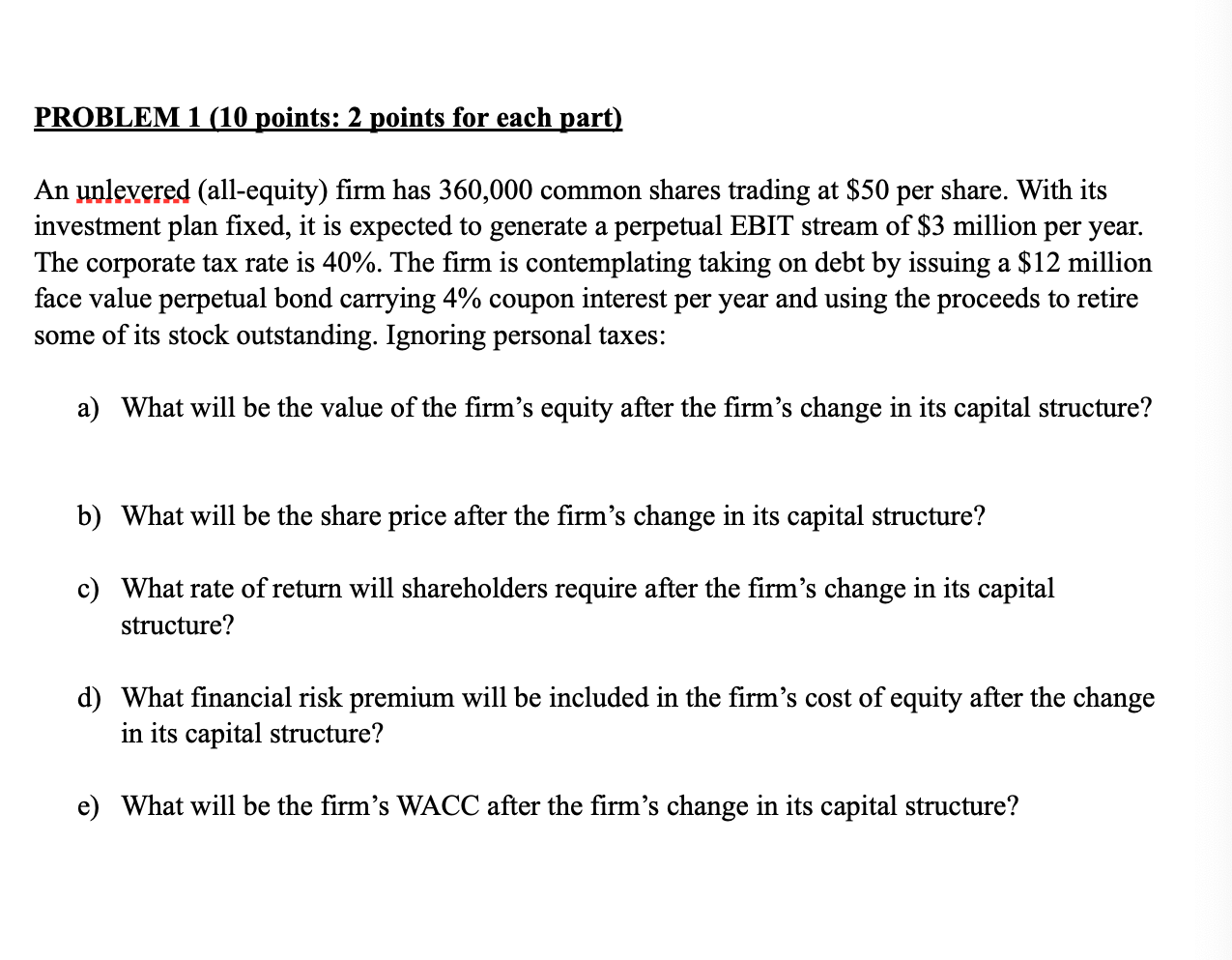

PROBLEM 1 (10 points: 2 points for each part) An unlevered (all-equity) firm has 360,000 common shares trading at $50 per share. With its investment plan fixed, it is expected to generate a perpetual EBIT stream of $3 million per year. The corporate tax rate is 40%. The firm is contemplating taking on debt by issuing a $12 million face value perpetual bond carrying 4% coupon interest per year and using the proceeds to retire some of its stock outstanding. Ignoring personal taxes: a) What will be the value of the firm's equity after the firm's change in its capital structure? b) What will be the share price after the firm's change in its capital structure? c) What rate of return will shareholders require after the firm's change in its capital structure? d) What financial risk premium will be included in the firm's cost of equity after the change in its capital structure? e) What will be the firm's WACC after the firm's change in its capital structure

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts