Question: Problem 1: 10 Points Indicate whether each of the items listed below would be included (l) in or excluded (E) from gross income for the

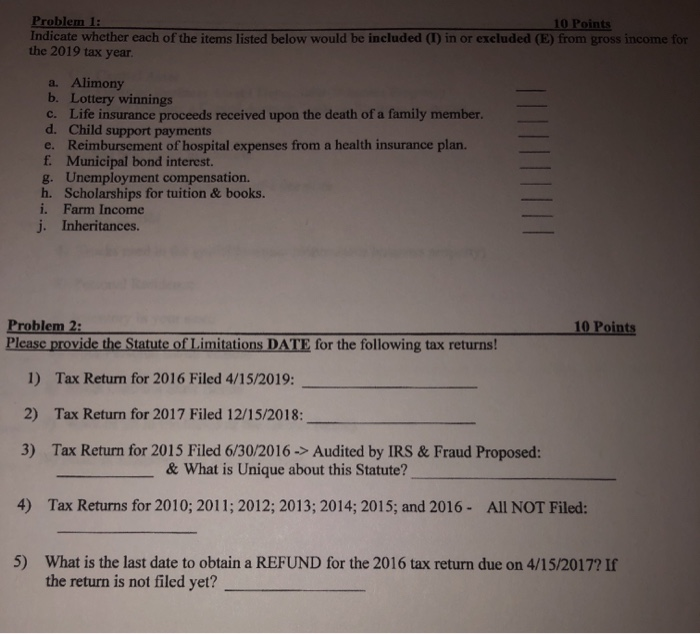

Problem 1: 10 Points Indicate whether each of the items listed below would be included (l) in or excluded (E) from gross income for the 2019 tax year a. Alimony b. Lottery winnings c. Life insurance proceeds received upon the death of a family member. d. Child support payments e. Reimbursement of hospital expenses from a health insurance plan. f. Municipal bond interest. g. Unemployment compensation. h. Scholarships for tuition & books. i. Farm Income j. Inheritances. 10 Points Problem 2: Please provide the Statute of Limitations DATE for the following tax returns! 1) Tax Return for 2016 Filed 4/15/2019: 2) Tax Return for 2017 Filed 12/15/2018: 3) Tax Return for 2015 Filed 6/30/2016 -> Audited by IRS & Fraud Proposed: & What is Unique about this Statute? 4) Tax Returns for 2010; 2011; 2012; 2013; 2014; 2015; and 2016 - All NOT Filed: 5) What is the last date to obtain a REFUND for the 2016 tax return due on 4/15/2017? If the return is not filed yet

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts