Question: Problem 1 - 10 points Three years ago, YQR Inc. issued a bond with a 10% coupon rate, semi-annual coupon payments, $1,000 face value and

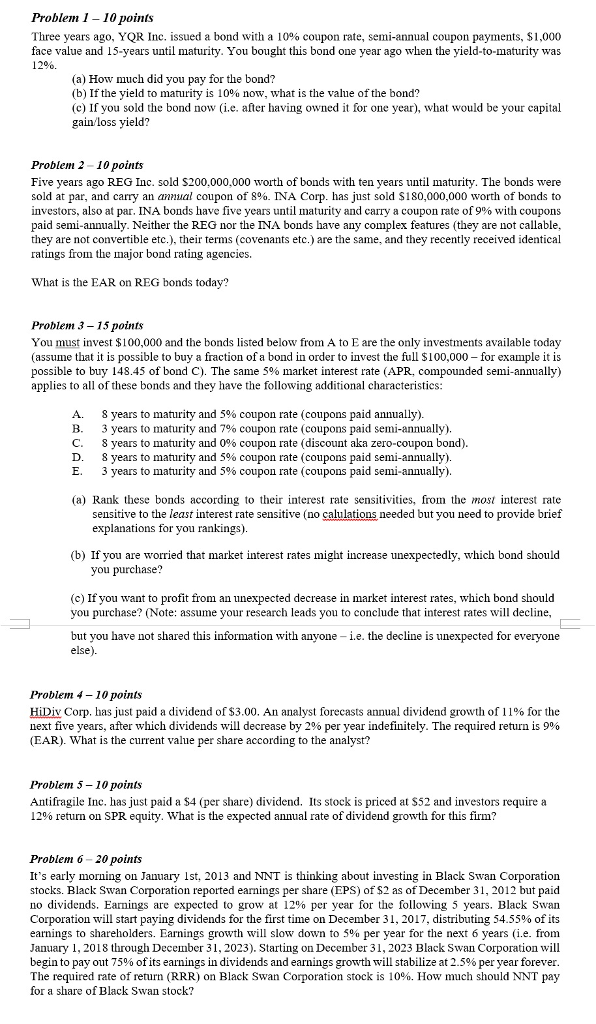

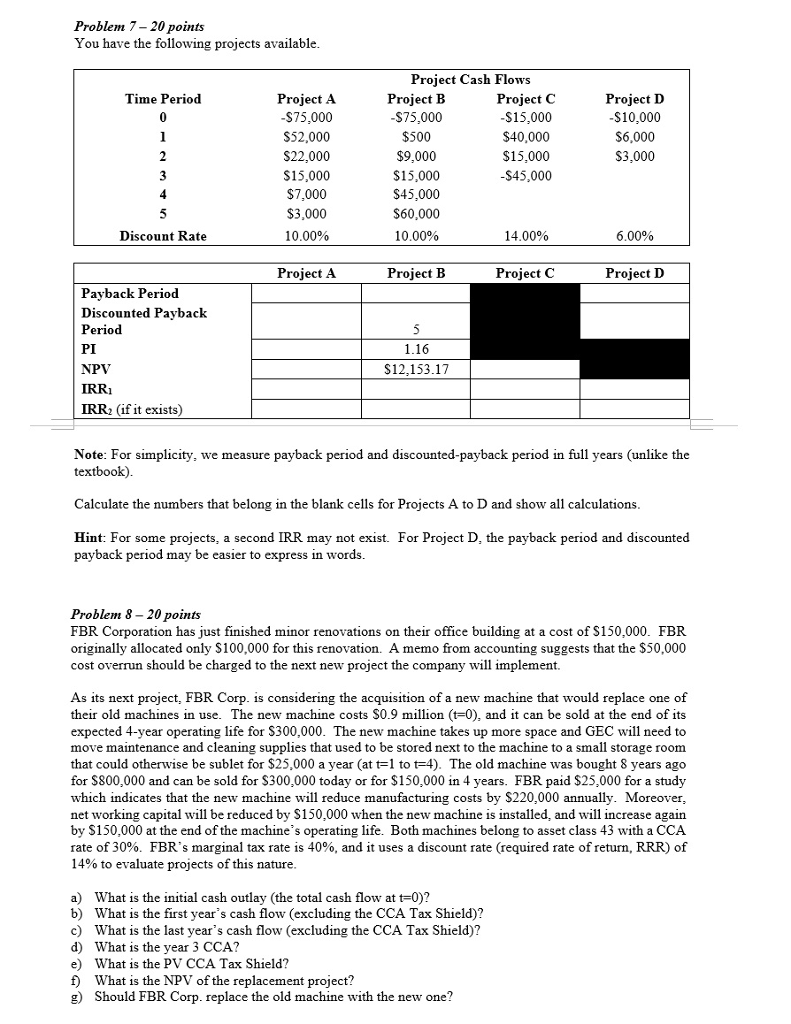

Problem 1 - 10 points Three years ago, YQR Inc. issued a bond with a 10% coupon rate, semi-annual coupon payments, $1,000 face value and 15-years until maturity. You bought this bond one year ago when the yield-to-maturity was 12%. (a) How much did you pay for the bond? (b) If the yield to maturity is 10% now, what is the value of the bond? (c) If you sold the bond now (i.e. after having owned it for one year), what would be your capital gain loss yield? Problem 2 -10 points Five years ago REG Inc. sold S200,000,000 worth of bonds with ten years until maturity. The bonds were sold at par, and carry an annual coupon of 8%. INA Corp. has just sold $180,000,000 worth of bonds to investors, also at par. INA bonds have five years until maturity and carry a coupon rate of 9% with coupons paid semi-annually. Neither the REG nor the INA bonds have any complex features (they are not callable, they are not convertible etc.), their terms (covenants etc.) are the same, and they recently received identical ratings from the major bond rating agencies. What is the EAR on REG bonds today? Problem 3 - 15 points You must invest $100,000 and the bonds listed below from A to E are the only investments available today (assume that it is possible to buy a fraction of a bond in order to invest the full S100,000 for example it is possible to buy 148.45 of bond C. The same 5% market interest rate (APR, compounded semi-annually) applies to all of these bonds and they have the following additional characteristics: A. B. C. D. E. 8 years to maturity and 5% coupon rate (coupons paid annually). 3 years to maturity and 7% coupon rate (coupons paid semi-annually). 8 years to maturity and 0% coupon rate (discount aka zero-coupon bond) 8 years to maturity and 5% coupon rate (coupons paid semi-annually). 3 years to maturity and 5% coupon rate (coupons paid semi-annually). (a) Rank these bonds according to their interest rate sensitivities, from the most interest rate sensitive to the least interest rate sensitive (no calulations needed but you need to provide brief explanations for you rankings). (b) If you are worried that market interest rates might increase unexpectedly, which bond should you purchase? (c) If you want to profit from an unexpected decrease in market interest rates, which bond should you purchase? (Note: assume your research leads you to conclude that interest rates will decline, but you have not shared this information with anyone i.e. the decline is unexpected for everyone else). Problem 4 - 10 points H Div Corp. has just paid a dividend of $3.00. An analyst forecasts annual dividend growth of 11% for the next five years, after which dividends will decrease by 2% per year indefinitely. "The required return is 9% (EAR). What is the current value per share according to the analyst? Problem 5 -10 points Antifragile Inc. has just paid a S4 (per share) dividend. Its stock is priced at S52 and investors requirea 12% return on SPR equity, what is the expected annual rate of dividend growth for this firm? Problem 6-20 points It's early morning on January lst, 2013 and NNT is thinking about investing in Black Swan Corporation stocks. Black Swan Corporation reported earnings per share (EPS) of S2 as of December 31, 2012 but paid no dividends. Earnings are expected to grow at 12% per year for the following 5 years. Black Swan Corporation will start paying dividends for the first time on December 31, 2017, distributing 54.55% of its earnings to shareholders. Earnings growth will slow down to 5% per year for the next 6 years (ie. from January 1, 2018 through December 31, 2023). Starting on December 31, 2023 Black Swan Corporation will begin to pay out 75% of its earnings in dividends and earnings growth will stabilize at 2.5% per year forever The required rate of return (RRR) on Black Swan Corporation stock is 10%. How much should NNT pay for a share of Black Swan stock

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts