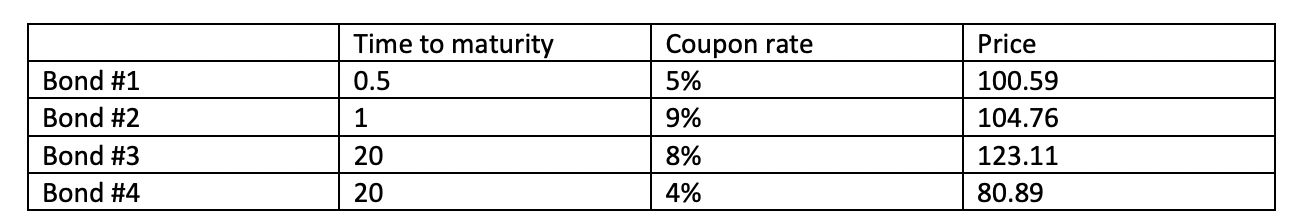

Question: Problem 1 (14 points): Consider the following information about four bonds and assume they are priced correctly: Time to maturity Coupon rate Price Bond #1

Problem 1 (14 points): Consider the following information about four bonds and assume they are priced correctly: Time to maturity Coupon rate Price Bond #1 0.5 5% 100.59 Bond #2 1 9% 104.76 Bond #3 20 8% 123.11 Bond #4 20 4% 80.89

a) (2 points) Find a 6-month spot interest rate. Keep at least 6 decimal digits while performing your calculations

b) (2 points) Find a 1-year forward interest rate. Keep at least 6 decimal digits while performing your calculations

c) (2 points) Find a 1-year spot interest rate. Keep at least 6 decimal digits while performing your calculations

d) (2 points) Find a 20-year spot interest rate. Keep at least 6 decimal digits while performing your calculations.

e) (3 points) Find the price of a 20-year 2% coupon bond. Keep at least 6 decimal digits while performing your calculations

f) (3 points) Find the price of a perpetuity that pays you $2 every six months (with the first payment 6 months from now) if all forward interest rates from year 20 to infinity are 6% (note: you cannot assume that all forward rates from now till infinity are 6%)

Time to maturity 0.5 1 Bond #1 Bond #2 Bond #3 Bond #4 Coupon rate 5% 9% 8% 4% Price 100.59 104.76 123.11 80.89 20 20 Time to maturity 0.5 1 Bond #1 Bond #2 Bond #3 Bond #4 Coupon rate 5% 9% 8% 4% Price 100.59 104.76 123.11 80.89 20 20

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts