Question: Problem 1 (15 marks) During 2022, John Doe Co. has the following depreciable assets and would like to take maximum CCA on each Class of

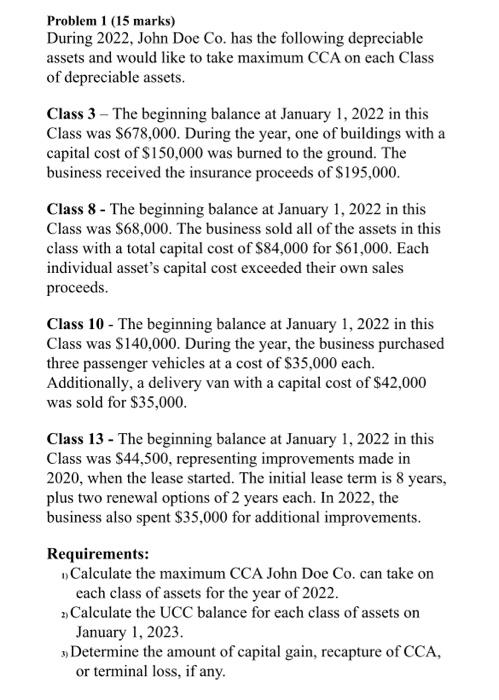

Problem 1 (15 marks) During 2022, John Doe Co. has the following depreciable assets and would like to take maximum CCA on each Class of depreciable assets. Class 3 - The beginning balance at January 1, 2022 in this Class was $678,000. During the year, one of buildings with a capital cost of $150,000 was burned to the ground. The business received the insurance proceeds of $195,000. Class 8 - The beginning balance at January 1, 2022 in this Class was $68,000. The business sold all of the assets in this class with a total capital cost of $84,000 for $61,000. Each individual asset's capital cost exceeded their own sales proceeds. Class 10 - The beginning balance at January 1, 2022 in this Class was $140,000. During the year, the business purchased three passenger vehicles at a cost of $35,000 each. Additionally, a delivery van with a capital cost of $42,000 was sold for $35,000. Class 13 - The beginning balance at January 1, 2022 in this Class was $44,500, representing improvements made in 2020 , when the lease started. The initial lease term is 8 years, plus two renewal options of 2 years each. In 2022, the business also spent $35,000 for additional improvements. Requirements: 1) Calculate the maximum CCA John Doe Co. can take on each class of assets for the year of 2022 . 2) Calculate the UCC balance for each class of assets on January 1, 2023. 3) Determine the amount of capital gain, recapture of CCA, or terminal loss, if any

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts