Question: Problem 1 (15 Marks) You have a portfolio made up of the following holdings: 5,000 shares of Anson Ltd, 2,800 shares of Carson Ltd (financial

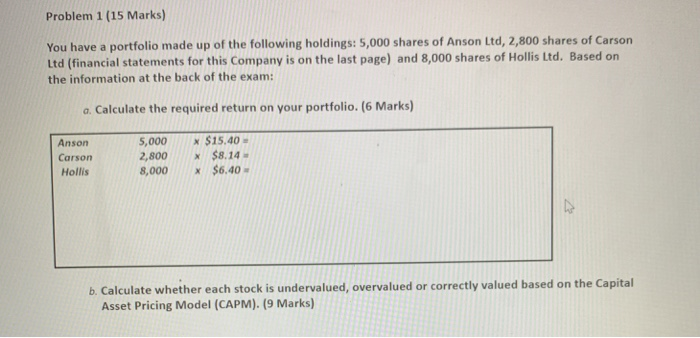

Problem 1 (15 Marks) You have a portfolio made up of the following holdings: 5,000 shares of Anson Ltd, 2,800 shares of Carson Ltd (financial statements for this Company is on the last page) and 8,000 shares of Hollis Ltd. Based on the information at the back of the exam: a. Calculate the required return on your portfolio. (6 Marks) Anson Carson Hollis 5,000 2,800 8,000 X $15.40 X $8.14 X $6.40 b. Calculate whether each stock is undervalued, overvalued or correctly valued based on the Capital Asset Pricing Model (CAPM). (9 Marks) Problem 1 (15 Marks) You have a portfolio made up of the following holdings: 5,000 shares of Anson Ltd, 2,800 shares of Carson Ltd (financial statements for this Company is on the last page) and 8,000 shares of Hollis Ltd. Based on the information at the back of the exam: a. Calculate the required return on your portfolio. (6 Marks) Anson Carson Hollis 5,000 2,800 8,000 X $15.40 X $8.14 X $6.40 b. Calculate whether each stock is undervalued, overvalued or correctly valued based on the Capital Asset Pricing Model (CAPM). (9 Marks)

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts