Question: Problem 1. (15 points) In Lecture 21 we learned two barrier options: the up-and-in call option and up-and-out call option. In this problem we are

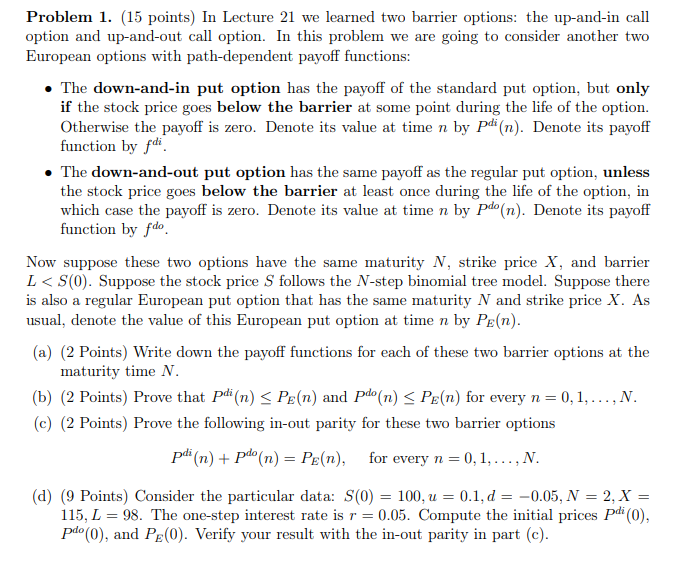

Problem 1. (15 points) In Lecture 21 we learned two barrier options: the up-and-in call option and up-and-out call option. In this problem we are going to consider another two European options with path-dependent payoff functions: The down-and-in put option has the payoff of the standard put option, but only if the stock price goes below the barrier at some point during the life of the option. Otherwise the payoff is zero. Denote its value at time n by pdi(n). Denote its payoff function by fdi The down-and-out put option has the same payoff as the regular put option, unless the stock price goes below the barrier at least once during the life of the option, in which case the payoff is zero. Denote its value at time n by pdo(n). Denote its payoff function by fdo Now suppose these two options have the same maturity N, strike price X, and barrier L

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts