Question: Problem 1 (15 points) Troy and Abby Henderson have two dependent children who live with them in Elburn. Troy manages a telemarketing firm from

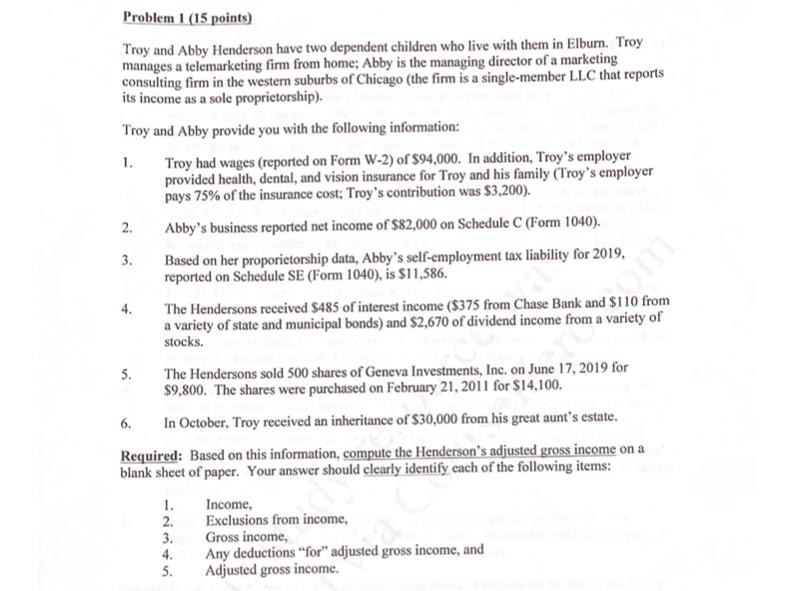

Problem 1 (15 points) Troy and Abby Henderson have two dependent children who live with them in Elburn. Troy manages a telemarketing firm from home; Abby is the managing director of a marketing consulting firm in the western suburbs of Chicago (the firm is a single-member LLC that reports its income as a sole proprietorship). Troy and Abby provide you with the following information: 1. Troy had wages (reported on Form W-2) of $94,000. In addition, Troy's employer provided health, dental, and vision insurance for Troy and his family (Troy's employer pays 75% of the insurance cost; Troy's contribution was $3,200). Abby's business reported net income of $82,000 on Schedule C (Form 1040). Based on her proporietorship data, Abby's self-employment tax liability for 2019, reported on Schedule SE (Form 1040), is $11,586. 2. 3. 4. 5. The Hendersons sold 500 shares of Geneva Investments, Inc. on June 17, 2019 for $9,800. The shares were purchased on February 21, 2011 for $14,100. In October, Troy received an inheritance of $30,000 from his great aunt's estate. Required: Based on this information, compute the Henderson's adjusted gross income on a blank sheet of paper. Your answer should clearly identify each of the following items: The Hendersons received $485 of interest income ($375 from Chase Bank and $110 from a variety of state and municipal bonds) and $2,670 of dividend income from a variety of stocks. 6. 1. 2. 3. 4. 5. Income, Exclusions from income, Gross income, Any deductions "for" adjusted gross income, and Adjusted gross income.

Step by Step Solution

3.41 Rating (145 Votes )

There are 3 Steps involved in it

ANSWER 1 Income Troys wages 94000 Abbys business income 82000 Interest i... View full answer

Get step-by-step solutions from verified subject matter experts