Question: Problem 1 ( 2 0 marks ) : Atlantic Groceries is a supermarket chain located in Nova Scotia. Atlantic Groceries is considering expanding into a

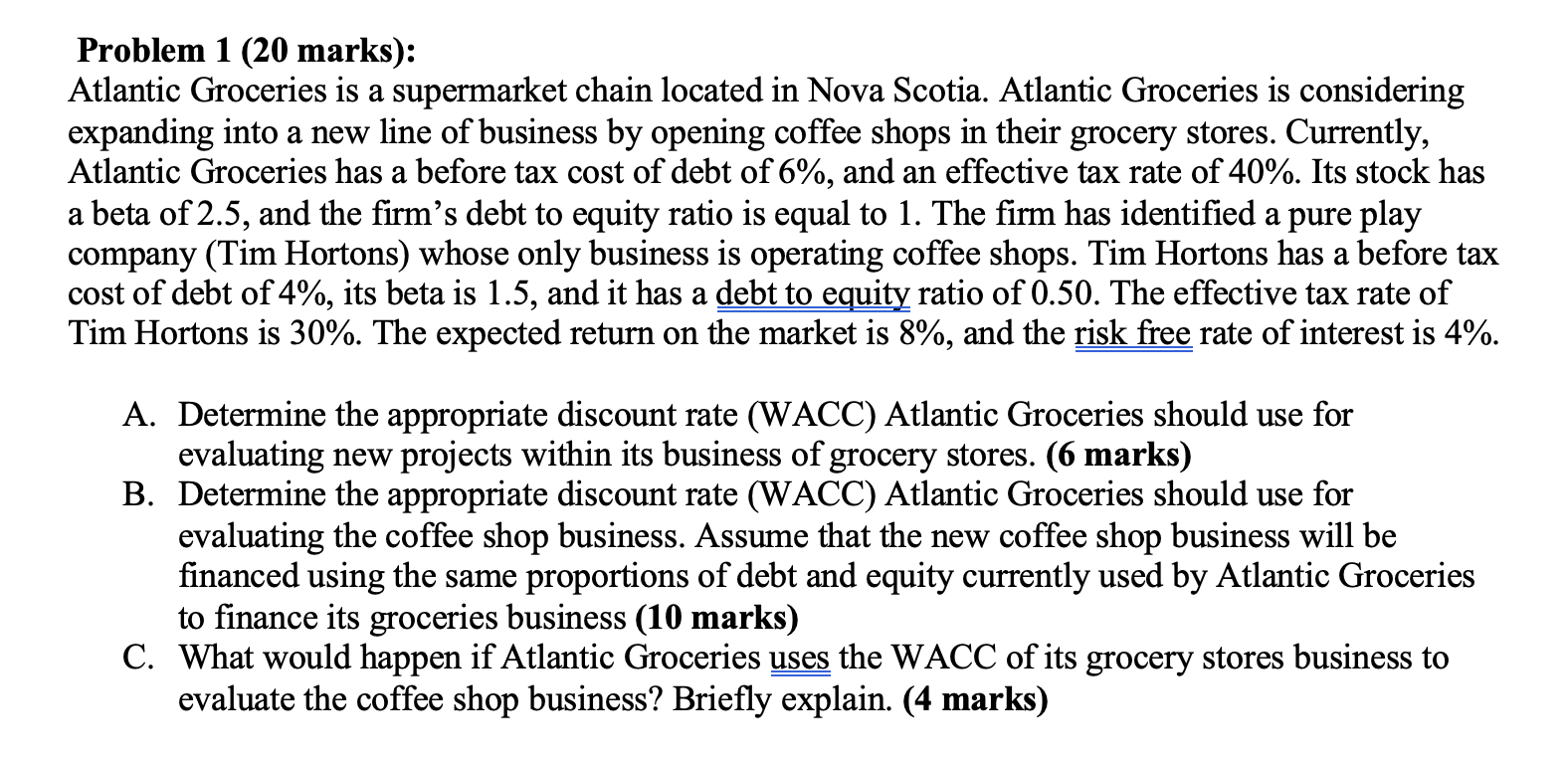

Problem marks: Atlantic Groceries is a supermarket chain located in Nova Scotia. Atlantic Groceries is considering expanding into a new line of business by opening coffee shops in their grocery stores. Currently, Atlantic Groceries has a before tax cost of debt of and an effective tax rate of Its stock has a beta of and the firm's debt to equity ratio is equal to The firm has identified a pure play company Tim Hortons whose only business is operating coffee shops. Tim Hortons has a before tax cost of debt of its beta is and it has a debt to equity ratio of The effective tax rate of Tim Hortons is The expected return on the market is and the risk free rate of interest is A Determine the appropriate discount rate WACC Atlantic Groceries should use for evaluating new projects within its business of grocery stores. marks B Determine the appropriate discount rate WACC Atlantic Groceries should use for evaluating the coffee shop business. Assume that the new coffee shop business will be financed using the same proportions of debt and equity currently used by Atlantic Groceries to finance its groceries business mathbf marks C What would happen if Atlantic Groceries uses the WACC of its grocery stores business to evaluate the coffee shop business? Briefly explain. marks

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock