Question: Problem 1 2 - 2 1 You must analyze a potential new product - a caulking compound that Cory Materials' R&D people developed for use

Problem

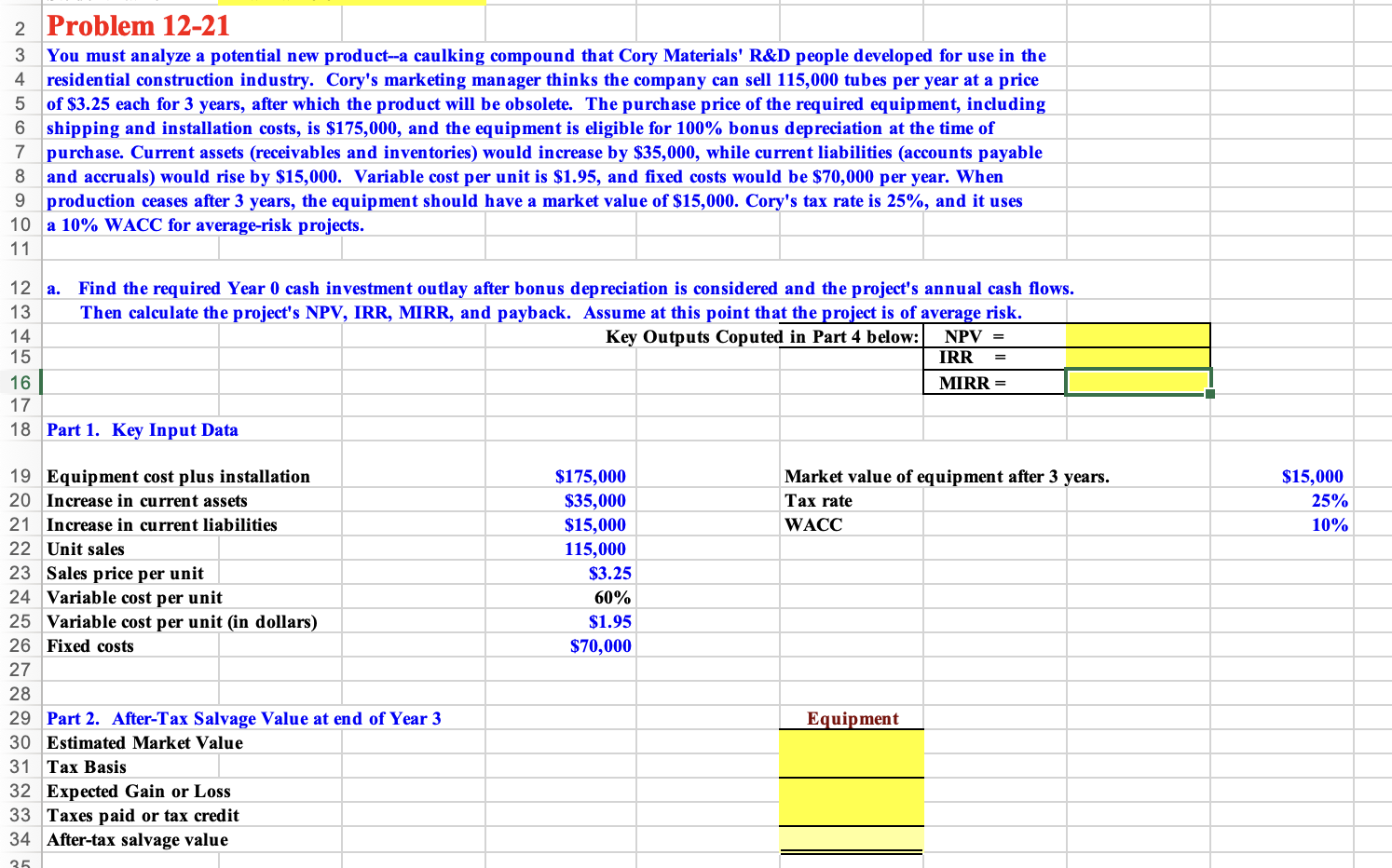

You must analyze a potential new producta caulking compound that Cory Materials' R&D people developed for use in the

residential construction industry. Cory's marketing manager thinks the company can sell tubes per year at a price

of $ each for years, after which the product will be obsolete. The purchase price of the required equipment, including

shipping and installation costs, is $ and the equipment is eligible for bonus depreciation at the time of

purchase. Current assets receivables and inventories would increase by $ while current liabilities accounts payable

and accruals would rise by $ Variable cost per unit is $ and fixed costs would be $ per year. When

production ceases after years, the equipment should have a market value of $ Cory's tax rate is and it uses

a WACC for averagerisk projects.

a Find the required Year cash investment outlay after bonus depreciation is considered and the project's annual cash flows.

Then calculate the project's NPV IRR, MIRR, and payback. Assume at this point that the project is of average risk.

Part Key Input Data

Equipment cost plus installation

Increase in current assets

Increase in current liabilities

Unit sales

Sales price per unit

Variable cost per unit

Variable cost per unit in dollars

Fixed costs

Market value of equipment after years.

Part AfterTax Salvage Value at end of Year

Equipment

Estimated Market Value

Tax Basis

Expected Gain or Loss

Taxes paid or tax credit

Aftertax salvage value

How to calculate the Excel formula as well please

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock