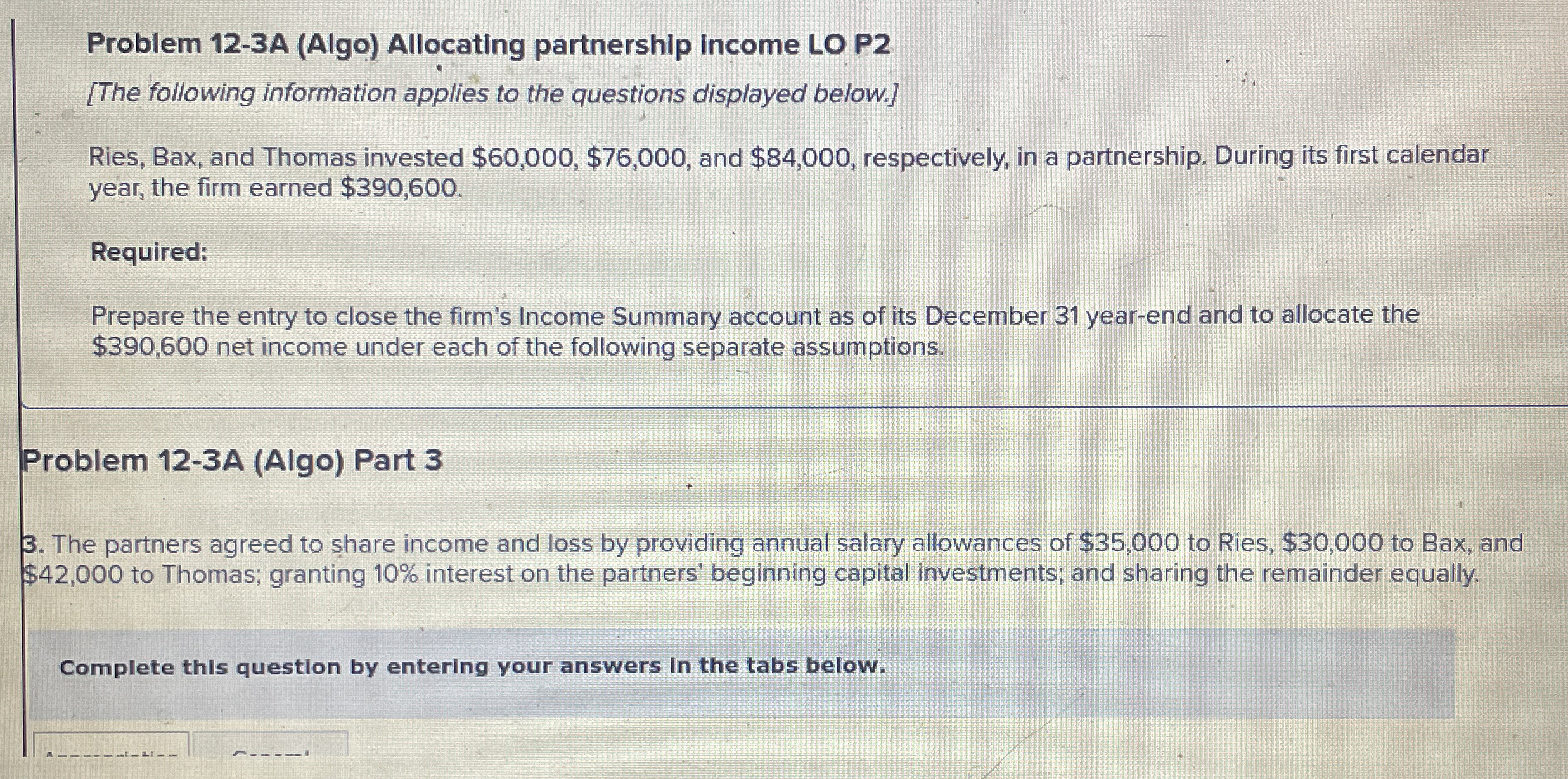

Question: Problem 1 2 - 3 A ( Algo ) Allocating partnership income LO P 2 [ The following information applies to the questions displayed below.

Problem A Algo Allocating partnership income LO P

The following information applies to the questions displayed below.

Ries, Bax, and Thomas invested $$ and $ respectively, in a partnership. During its first calendar

year, the firm earned $

Required:

Prepare the entry to close the firm's Income Summary account as of its December yearend and to allocate the

$ net income under each of the following separate assumptions.

Problem A Algo Part

The partners agreed to share income and loss by providing annual salary allowances of $ to Ries, $ to Bax, and

$ to Thomas; granting interest on the partners' beginning capital investments; and sharing the remainder equally.

Complete this question by entering your answers in the tabs below.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock