Question: Problem 1 2 - 4 4 ( LO 1 2 - 3 ) ( Static ) Brady recently graduated from SUNY - New Paltz with

Problem LO Static

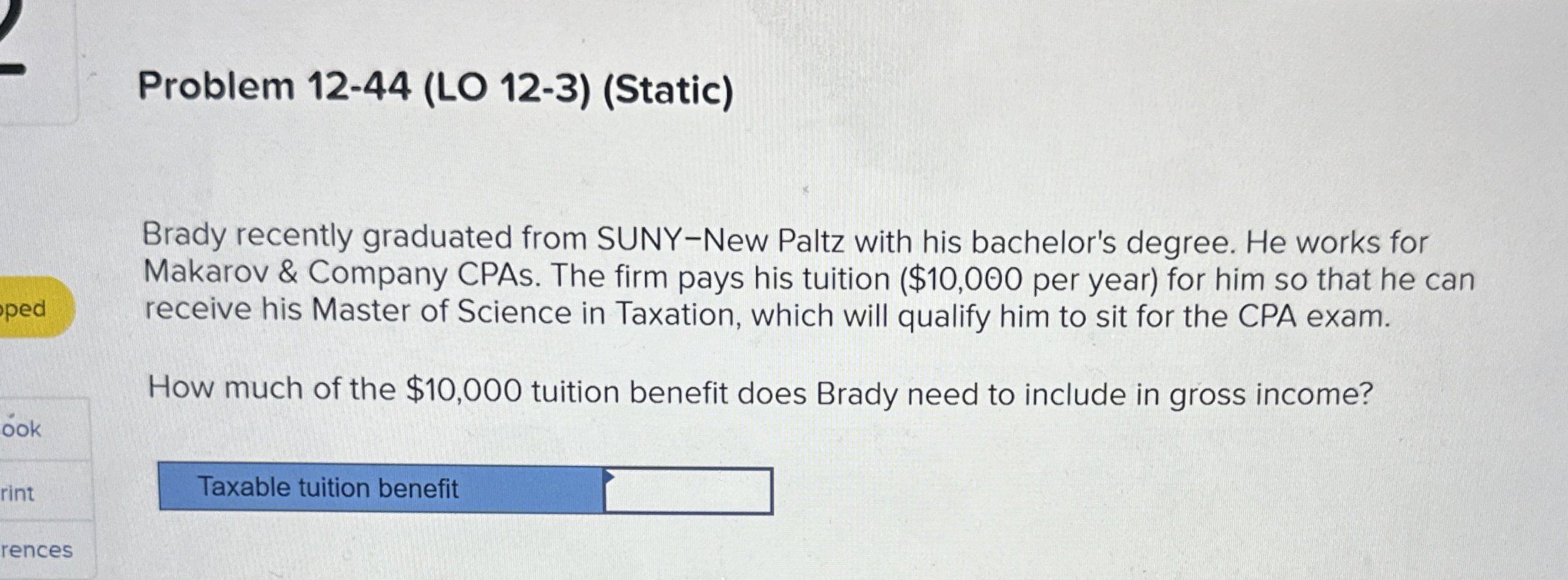

Brady recently graduated from SUNYNew Paltz with his bachelor's degree. He works for Makarov & Company CPAs. The firm pays his tuition $ per year for him so that he can receive his Master of Science in Taxation, which will qualify him to sit for the CPA exam.

How much of the $ tuition benefit does Brady need to include in gross income?

Taxable tuition benefit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock