Question: Problem 1 2 - 8 After - Tax Cash Flow from Sale of Assets ( LG 1 2 - 4 ) Your firm needs a

Problem AfterTax Cash Flow from Sale of Assets LG

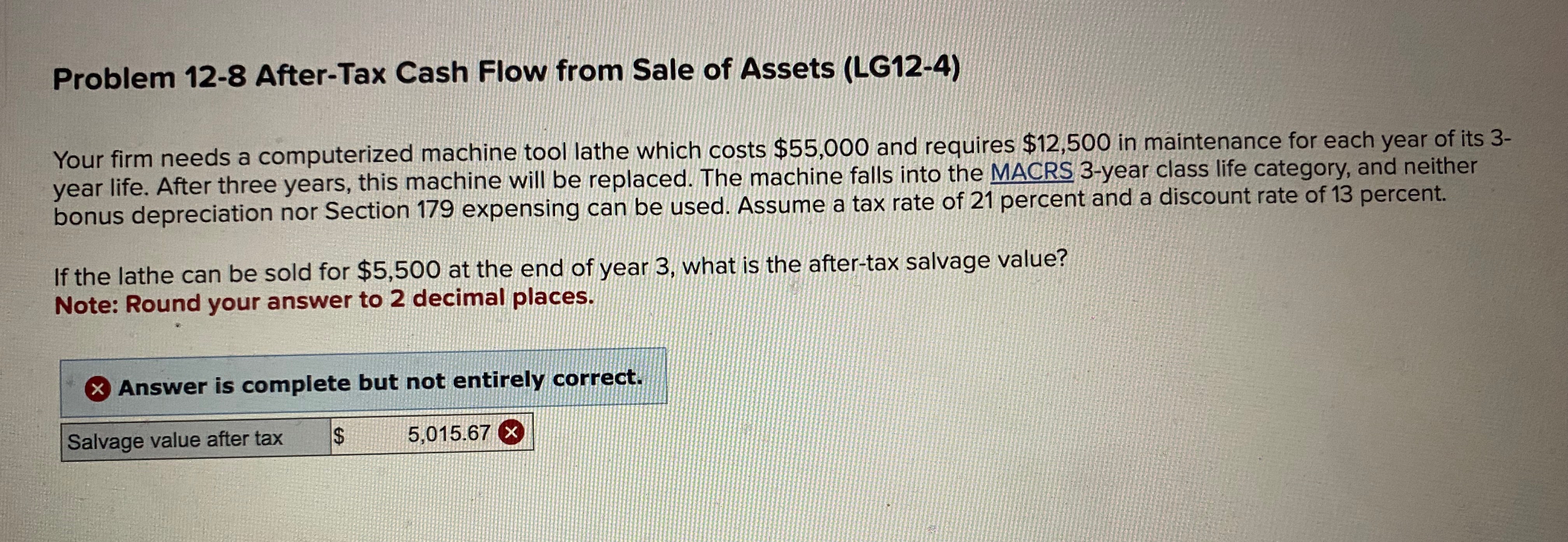

Your firm needs a computerized machine tool lathe which costs $ and requires $ in maintenance for each year of its year life. After three years, this machine will be replaced. The machine falls into the MACRS year class life category, and neither bonus depreciation nor Section expensing can be used. Assume a tax rate of percent and a discount rate of percent.

If the lathe can be sold for $ at the end of year what is the aftertax salvage value?

Note: Round your answer to decimal places.

Answer is complete but not entirely correct.

tablelue after tax,$

Problem AfterTax Cash Flow from Sale of Assets LG

Your firm needs a computerized machine tool lathe which costs $ and requires $ in maintenance for each year of its year life. After three years, this machine will be replaced. The machine falls into the MACRS year class life category, and neither bonus depreciation nor Section expensing can be used. Assume a tax rate of percent and a discount rate of percent.

If the lathe can be sold for $ at the end of year what is the aftertax salvage value?

Note: Round your answer to decimal places.

Answer is complete but not entirely correct.

tablelue after tax,$

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock