Question: Problem 1 2 - 8 Book Value versus Market Value Problem 1 2 - 8 Book Value versus Market Value Pandora Manufacturing has 8 million

Problem Book Value versus Market Value Problem Book Value versus Market Value

Pandora Manufacturing has million shares of common stock outstanding. The current

share price is $ and the book value per share is $ The company also has two bond

issues outstanding. The first bond issue has a face value of $ million and a coupon

rate of percent and sells for percent of par. The second issue has a face value of

$ million and a coupon rate of percent and sells for percent of par. The first

issue matures in years, the second in years.

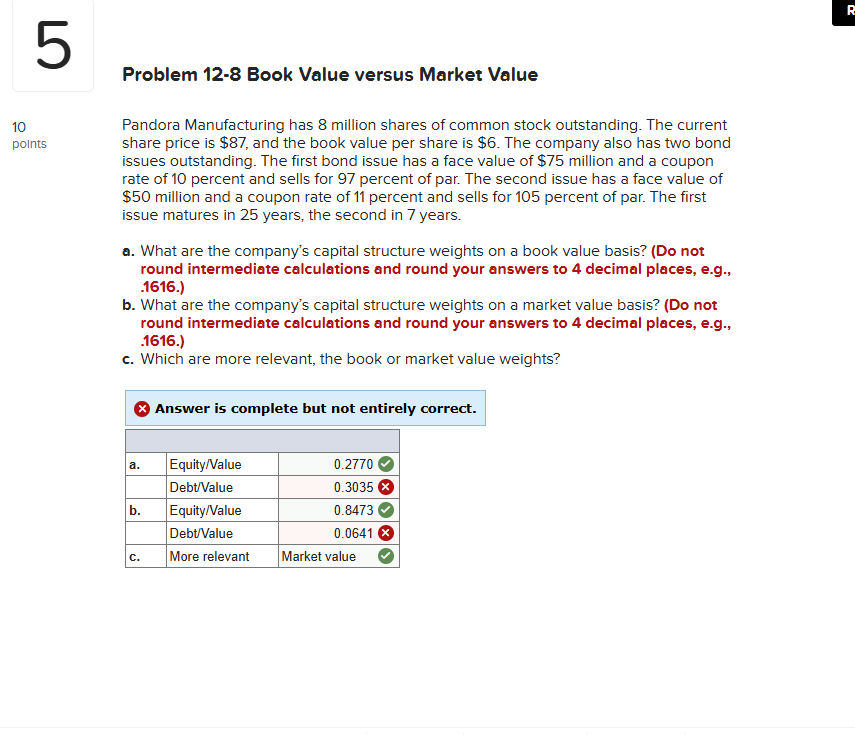

a What are the company's capital structure weights on a book value basis? Do not

round intermediate calculations and round your answers to decimal places, eg

b What are the company's capital structure weights on a market value basis? Do not

round intermediate calculations and round your answers to decimal places, eg

c Which are more relevant, the book or market value weights?

Answer is complete but not entirely correct.

Pandora Manufacturing has million shares of common stock outstanding. The current

share price is $ and the book value per share is $ The company also has two bond

issues outstanding. The first bond issue has a face value of $ million and a coupon

rate of percent and sells for percent of par. The second issue has a face value of

$ million and a coupon rate of percent and sells for percent of par. The first

issue matures in years, the second in years.

a What are the company's capital structure weights on a book value basis? Do not

round intermediate calculations and round your answers to decimal places, eg

b What are the company's capital structure weights on a market value basis? Do not

round intermediate calculations and round your answers to decimal places, eg

c Which are more relevant, the book or market value weights?

Answer is complete but not entirely correct.

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock