Question: Problem 1 2 On January 1 , 2 0 2 4 , Isabelle closed on the purchase of a newly constructed home in Virginia Beach

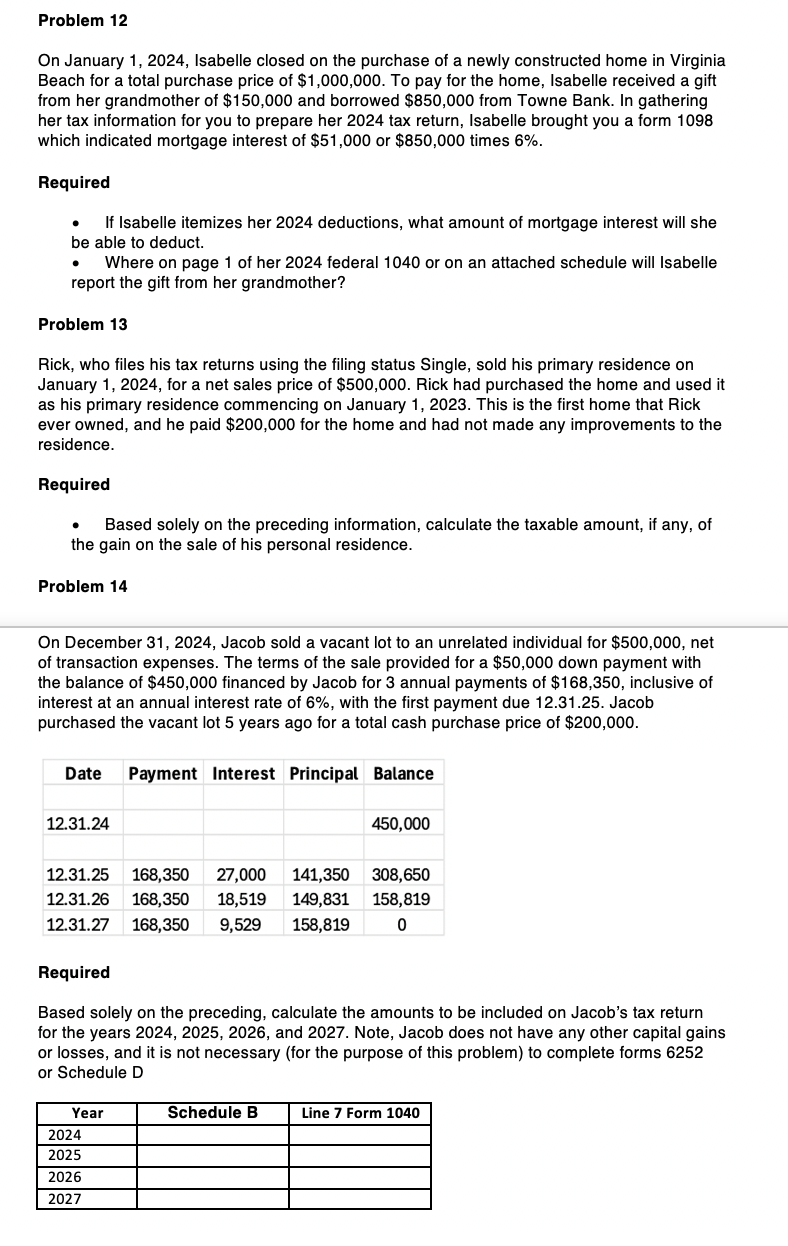

Problem On January Isabelle closed on the purchase of a newly constructed home in Virginia Beach for a total purchase price of $ To pay for the home, Isabelle received a gift from her grandmother of $ and borrowed $ from Towne Bank. In gathering her tax information for you to prepare her tax return, Isabelle brought you a form which indicated mortgage interest of $ or $ times Required If Isabelle itemizes her deductions, what amount of mortgage interest will she be able to deduct. Where on page of her federal or on an attached schedule will Isabelle report the gift from her grandmother? Problem Rick, who files his tax returns using the filing status Single, sold his primary residence on January for a net sales price of $ Rick had purchased the home and used it as his primary residence commencing on January This is the first home that Rick ever owned, and he paid $ for the home and had not made any improvements to the residence. Required Based solely on the preceding information, calculate the taxable amount, if any, of the gain on the sale of his personal residence. Problem On December Jacob sold a vacant lot to an unrelated individual for $ net of transaction expenses. The terms of the sale provided for a $ down payment with the balance of $ financed by Jacob for annual payments of $ inclusive of interest at an annual interest rate of with the first payment due Jacob purchased the vacant lot years ago for a total cash purchase price of $ Required Based solely on the preceding, calculate the amounts to be included on Jacob's tax return for the years and Note, Jacob does not have any other capital gains or losses, and it is not necessary for the purpose of this problem to complete forms or Schedule D

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock