Question: Problem 1: (2 points) Bata is proposing to acquire Apex Inc. for the benefit of cost savings from overlapping businesses. If the combined company save

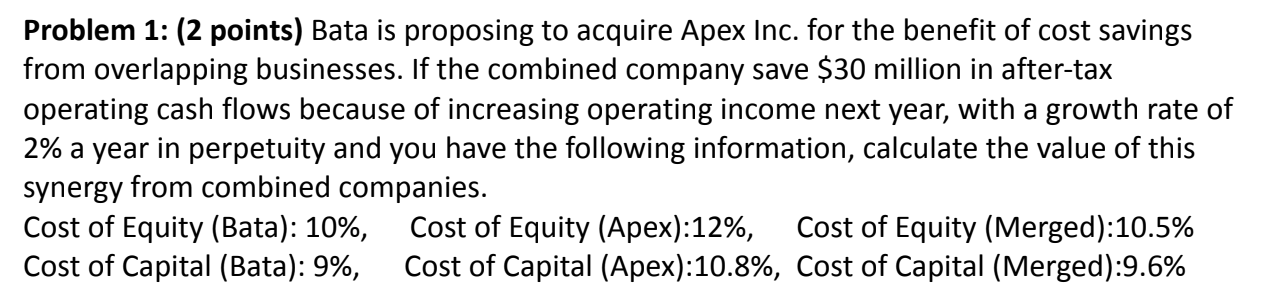

Problem 1: (2 points) Bata is proposing to acquire Apex Inc. for the benefit of cost savings from overlapping businesses. If the combined company save $30 million in after-tax operating cash flows because of increasing operating income next year, with a growth rate of 2% a year in perpetuity and you have the following information, calculate the value of this synergy from combined companies. Cost of Equity (Bata): 10%, Cost of Equity (Apex):12%, Cost of Equity (Merged):10.5% Cost of Capital (Bata): 9%, Cost of Capital (Apex):10.8%, Cost of Capital (Merged):9.6%

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts