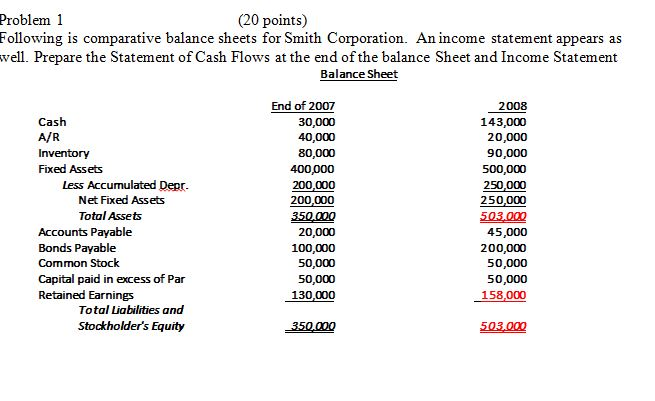

Question: Problem 1 (20 points) Following is comparative balance sheets for Smith Corporation. An income statement appears as well. Prepare the Statement of Cash Flows at

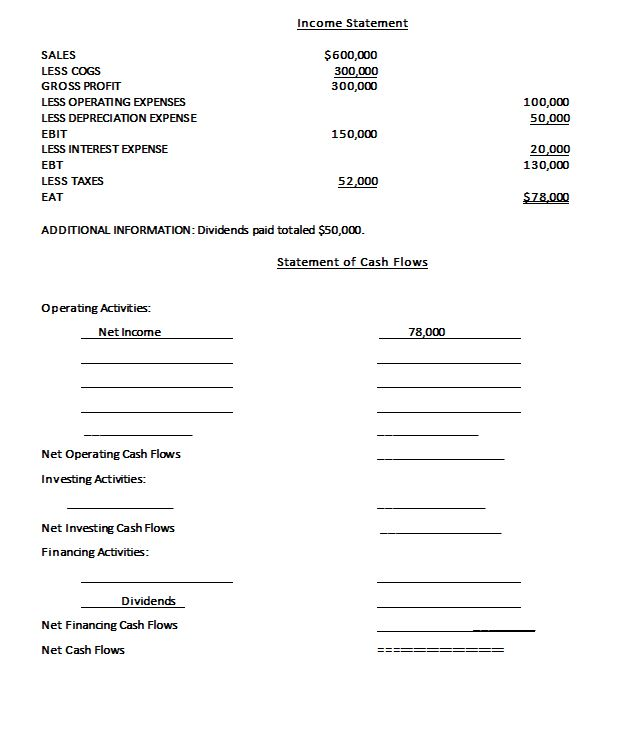

Problem 1 (20 points) Following is comparative balance sheets for Smith Corporation. An income statement appears as well. Prepare the Statement of Cash Flows at the end of the balance Sheet and Income Statement Balance Sheet Cash A/R Inventory Fixed Assets Less Accumulated Depr. Net Fixed Assets Total Assets Accounts Payable Bonds Payable Common Stock Capital paid in excess of Par Retained Earnings Total Liabilities and Stockholder's Equity End of 2007 30,000 40,000 80,000 400,000 200,000 200,000 350,000 20,000 100,000 50,000 50,000 130,000 2008 143,000 20,000 90,000 500,000 250,000 250,000 503.000 45,000 200,000 50,000 50,000 158,000 350,000 503.000 Income Statement $600,000 300,000 300,000 100,000 50,000 SALES LESS COGS GROSS PROFIT LESS OPERATING EXPENSES LESS DEPRECIATION EXPENSE EBIT LESS INTEREST EXPENSE EBT LESS TAXES EAT 150,000 20,000 130,000 52,000 $78,000 ADDITIONAL INFORMATION: Dividends paid totaled $50,000. Statement of Cash Flows Operating Activities: Net Income 78,000 Net Operating Cash Flows Investing Activities: Net Investing Cash Flows Financing Activities: Dividends Net Financing Cash Flows Net Cash Flows

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts