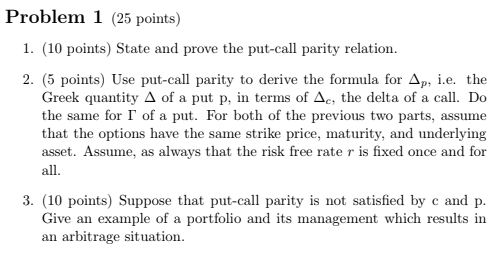

Question: Problem 1 (25 points) 1. (10 points) State and prove the put-call parity relation 2. (5 points) Use put-call parity to derive the formula for

Problem 1 (25 points) 1. (10 points) State and prove the put-call parity relation 2. (5 points) Use put-call parity to derive the formula for Ap, i.e. the Greek quantity A of a put p, in terms of Ae, the delta of a call. Do the same for of a put. For both of the previous two parts, that the options have the same strike price, maturity, and underly ing asset. Assume, as always that the risk free rate r is fixed once and for all assume 3. (10 points) Suppose that put-call parity is not satisfied by c and p Give an example of a portfolio and its management which results in arbitrage situation an Problem 1 (25 points) 1. (10 points) State and prove the put-call parity relation 2. (5 points) Use put-call parity to derive the formula for Ap, i.e. the Greek quantity A of a put p, in terms of Ae, the delta of a call. Do the same for of a put. For both of the previous two parts, that the options have the same strike price, maturity, and underly ing asset. Assume, as always that the risk free rate r is fixed once and for all assume 3. (10 points) Suppose that put-call parity is not satisfied by c and p Give an example of a portfolio and its management which results in arbitrage situation an

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts