Question: Problem #1 (25 points) This is problem 12.19 in the book: l'm making some changes to it. Assume that Radovilsky now imports its flashing lights

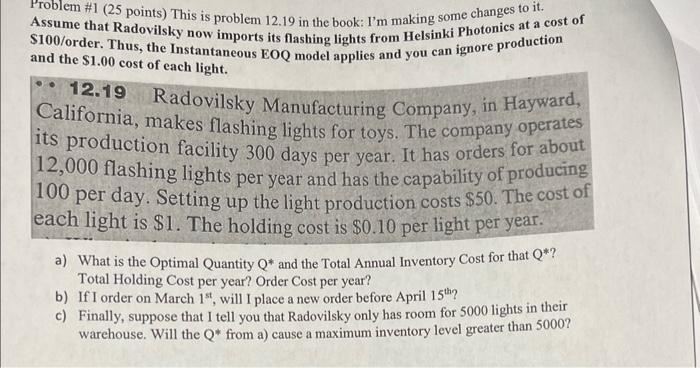

Problem \#1 (25 points) This is problem 12.19 in the book: l'm making some changes to it. Assume that Radovilsky now imports its flashing lights from Helsinki Photonics at a cost of \$100/order. Thus, the Instantaneous EOQ model applies and you can ignore production and the $1.00 cost of each light. California, makes flashing lights for toys. The company operates California, makes flashing lights for toys. The company operates 12,000 flashing lights per year and has the capability of producing 100 per day. Setting up the light production costs $50. The cost of each light is $1. The holding cost is $0.10 per light per year. a) What is the Optimal Quantity Q and the Total Annual Inventory Cost for that Q ? Total Holding Cost per year? Order Cost per year? b) If I order on March 1st, will I place a new order before April 15th ? c) Finally, suppose that I tell you that Radovilsky only has room for 5000 lights in their warehouse. Will the Q from a) cause a maximum inventory level greater than 5000

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts