Question: Problem 1 (25%) - Suppose you are 25 years old and start thinking about your pension fund. You plan to go in pension when completing

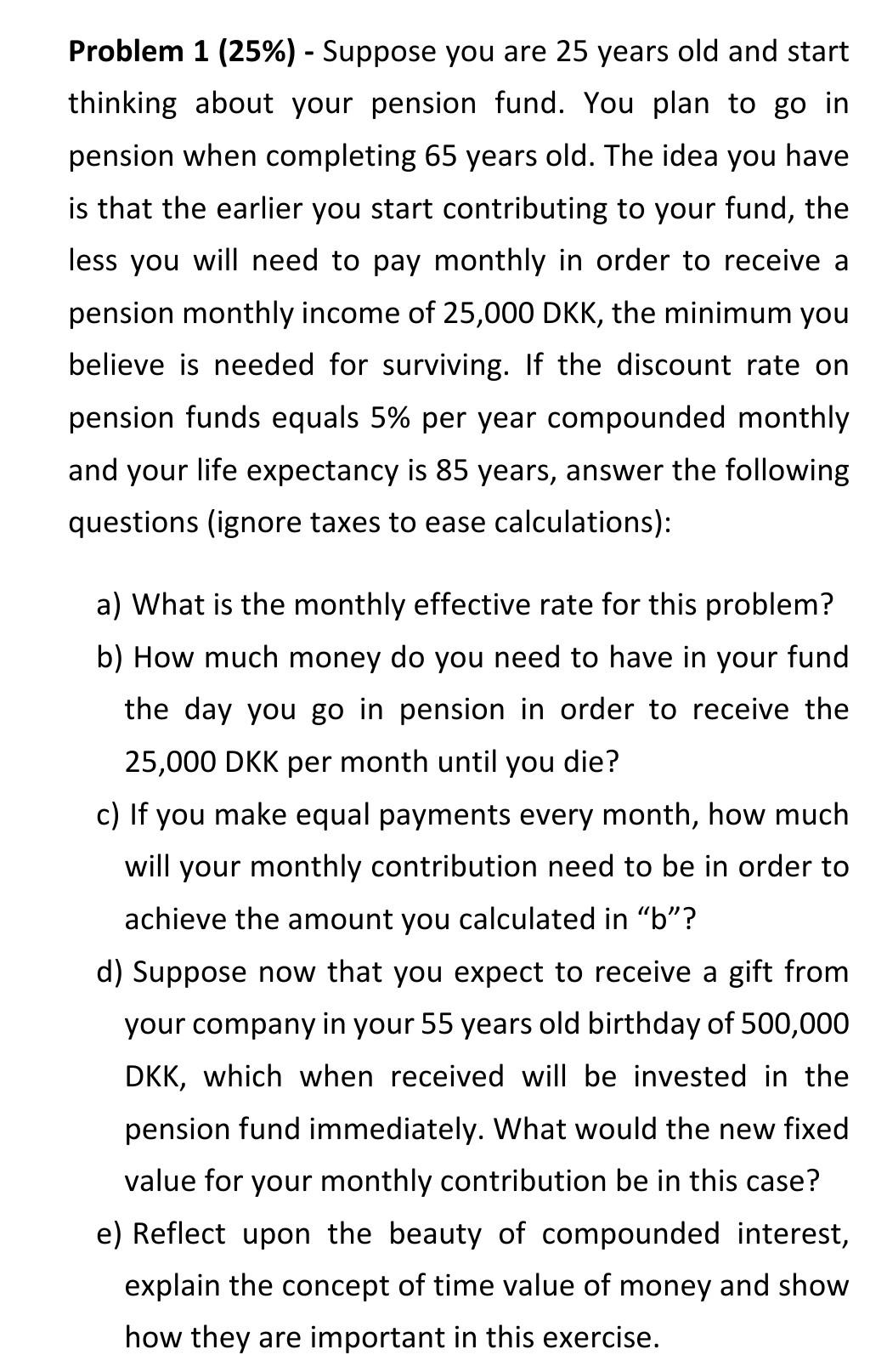

Problem 1 (25\%) - Suppose you are 25 years old and start thinking about your pension fund. You plan to go in pension when completing 65 years old. The idea you have is that the earlier you start contributing to your fund, the less you will need to pay monthly in order to receive a pension monthly income of 25,000DKK, the minimum you believe is needed for surviving. If the discount rate on pension funds equals 5% per year compounded monthly and your life expectancy is 85 years, answer the following questions (ignore taxes to ease calculations): a) What is the monthly effective rate for this problem? b) How much money do you need to have in your fund the day you go in pension in order to receive the 25,000 DKK per month until you die? c) If you make equal payments every month, how much will your monthly contribution need to be in order to achieve the amount you calculated in " b "? d) Suppose now that you expect to receive a gift from your company in your 55 years old birthday of 500,000 DKK, which when received will be invested in the pension fund immediately. What would the new fixed value for your monthly contribution be in this case? e) Reflect upon the beauty of compounded interest, explain the concept of time value of money and show how they are important in this exercise

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts