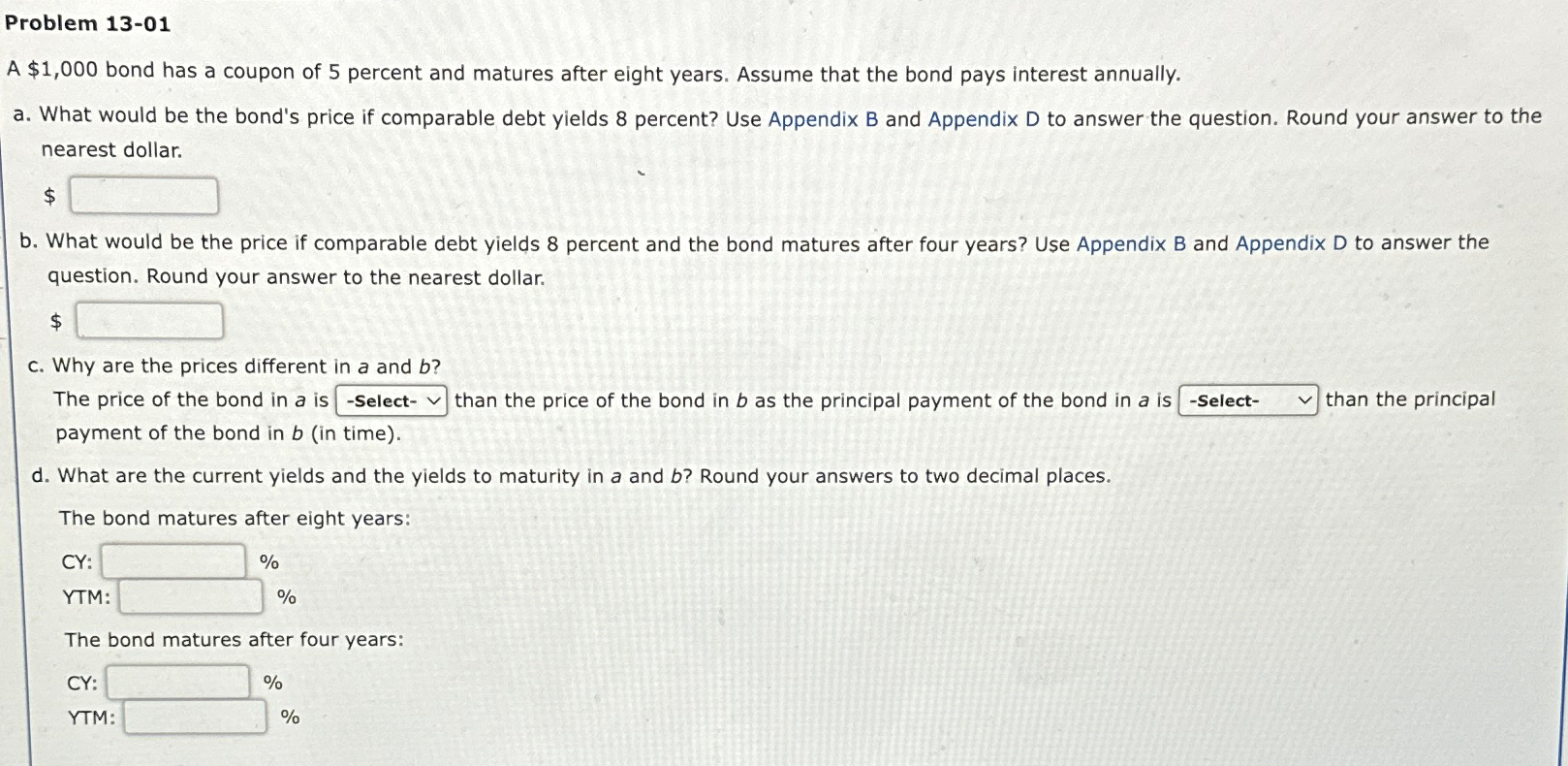

Question: Problem 1 3 - 0 1 A $ 1 , 0 0 0 bond has a coupon of 5 percent and matures after eight years.

Problem

A $ bond has a coupon of percent and matures after eight years. Assume that the bond pays interest annually.

a What would be the bond's price if comparable debt yields percent? Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar.

$

b What would be the price if comparable debt yields percent and the bond matures after four years? Use Appendix B and Appendix D to answer the question. Round your answer to the nearest dollar.

$

c Why are the prices different in a and

The price of the bond in is than the price of the bond in as the principal payment of the bond in is than the principal payment of the bond in in time

d What are the current yields and the yields to maturity in a and Round your answers to two decimal places.

The bond matures after eight years:

tableCY:

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock