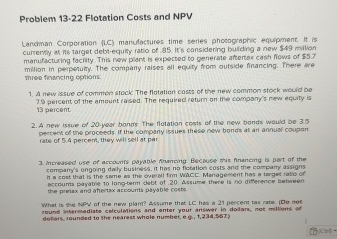

Question: Problem 1 3 - 2 2 Flotation Costs and NPV Landman Corporatoon ( LC ) manulachures time serles phooographic equipment it is curtertly at ins

Problem Flotation Costs and NPV

Landman Corporatoon LC manulachures time serles phooographic equipment it is curtertly at ins target debtequify ratio of It's cansidering buliding a new $ milion marufacturing facfity This fow plant is expected to generate aftertar cash flows of $ milion in perperuiny. The company raises all equity from outside financing. There are three finarking options:

A ftew ksue of commion srock The flotation casss of the new common stock would be percent of the ambunt rased. The requived return on the componys new equaty is percent.

A new isque of your bondis The flatation costs of the new bonds wauld be pecrects of the proceeds. If the company issues these new bonds at an annual coupan rate of percent, they well sell at par

Increased use of accourtis paysble frumcing Because this financing is part of the compary's ongoing daly busitiss, it hes no flotation costs and the compary assigns Accourta payabie longterm debt of Assume there is no ditference betiwen the prevax and afiertax accounts payable coets

What is the NPU of the new plam? Assume that LC has a percent tas rate. Do not nound insermediate colculatiens and anter your answer in dolars, not millens of dolars, rounded to the nearest whale numbet, e

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock