Question: Problem 1 3 - 4 1 ( LO . 5 ) GinnyCo has pretax book and taxable income of ( $ 4 0

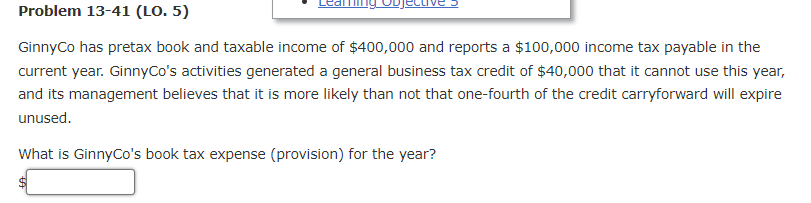

Problem LO GinnyCo has pretax book and taxable income of $ and reports a $ income tax payable in the current year. GinnyCo's activities generated a general business tax credit of $ that it cannot use this year, and its management believes that it is more likely than not that onefourth of the credit carryforward will expire unused. What is GinnyCo's book tax expense provision for the year? $

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock