Question: Problem 1 3 - 4 3 ( L O . 7 ) Jazz, Inc., claimed $ 1 0 0 , 0 0 0 o f

Problem

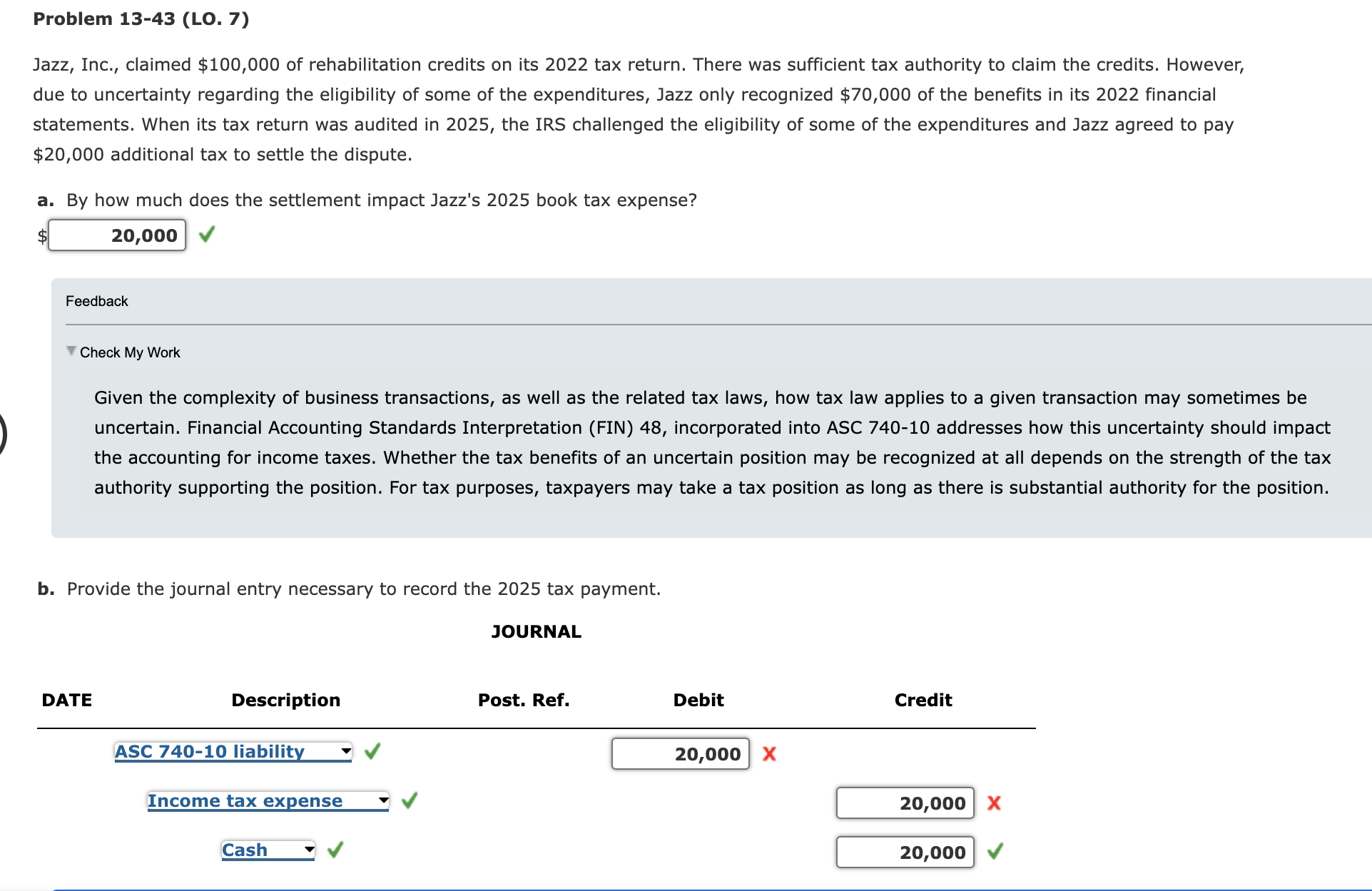

Jazz, Inc., claimed $ rehabilitation credits its tax return. There was sufficient tax authority claim the credits. However,

due uncertainty regarding the eligibility some the expenditures, Jazz only recognized $ the benefits its financial

statements. When its tax return was audited the IRS challenged the eligibility some the expenditures and Jazz agreed pay

$ additional tax settle the dispute.

how much does the settlement impact Jazz's book tax expense?

Check Work

Given the complexity business transactions, well the related tax laws, how tax law applies a given transaction may sometimes

uncertain. Financial Accounting Standards Interpretation incorporated into ASC addresses how this uncertainty should impact

the accounting for income taxes. Whether the tax benefits uncertain position may recognized all depends the strength the tax

authority supporting the position. For tax purposes, taxpayers may take a tax position long there substantial authority for the position.

Provide the journal entry necessary record the tax payment.

JOURNAL

DATE

Description

Post. Ref.

Debit

Credit

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock