Question: Problem 1 3 - 6 2 ( LO 1 3 - 2 ) ( Static ) Nitai ( age 4 0 ) contributes 1 0

Problem LO Static

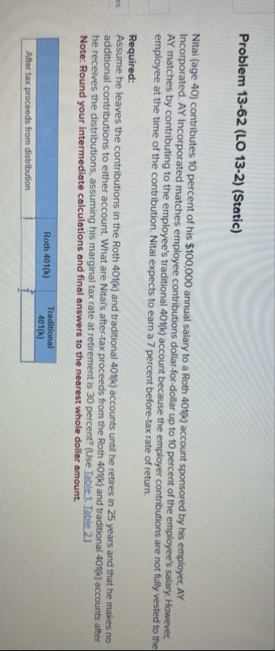

Nitai age contributes percent of his $ annual salary to a Roth k account sponsored by his employer, AY Incorporated. AY Incorporated matches employee contributions dollarfordollar up to percent of the employee's salary. However, AY matches by contributing to the employee's traditional account because the employer contributions are not fully vested to the employee at the time of the contribution. Nital expects to earn a percent beforetax rate of return.

Required:

Assume he leaves the contributions in the Roth and traditional accounts until he retires in years and that he makes no additional contributions to either account. What are Nitai's aftertax proceeds from the Roth and traditional k

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock