Question: Problem 1 . 3 In table 1 . 3 below, information about the market index, asset E and the risk - free as - set

Problem

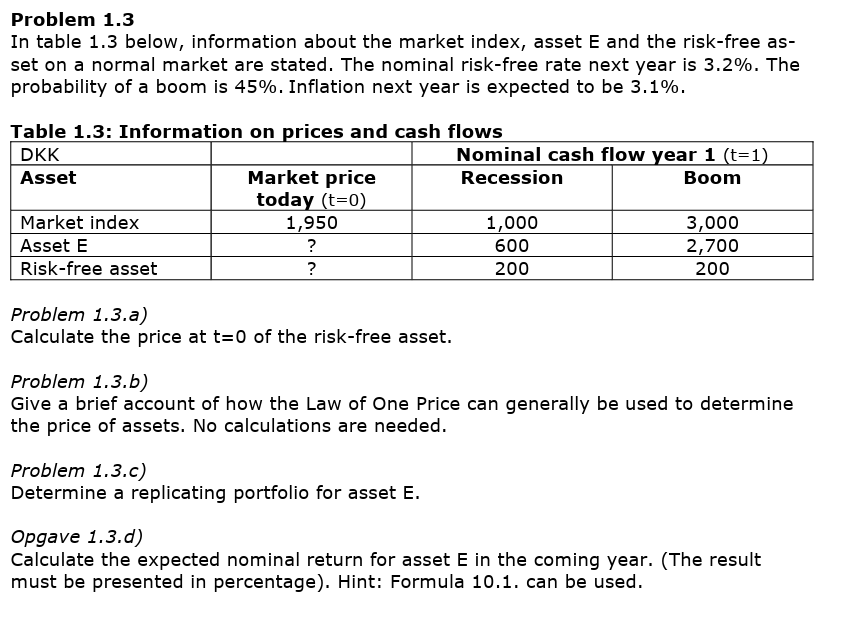

In table below, information about the market index, asset and the riskfree as

set on a normal market are stated. The nominal riskfree rate next year is The

probability of a boom is Inflation next year is expected to be

Table : Information on prices and cash flows

Problem a

Calculate the price at of the riskfree asset.

Problem b

Give a brief account of how the Law of One Price can generally be used to determine

the price of assets. No calculations are needed.

Problem c

Determine a replicating portfolio for asset

Opgave d

Calculate the expected nominal return for asset in the coming year. The result

must be presented in percentage

Step by Step Solution

There are 3 Steps involved in it

1 Expert Approved Answer

Step: 1 Unlock

Question Has Been Solved by an Expert!

Get step-by-step solutions from verified subject matter experts

Step: 2 Unlock

Step: 3 Unlock