Question: PROBLEM 1 - 3 points On January 1, 2020 Multinational Company was organized with an authorized share capital of P10,000,000 consisting of 100,000 shares of

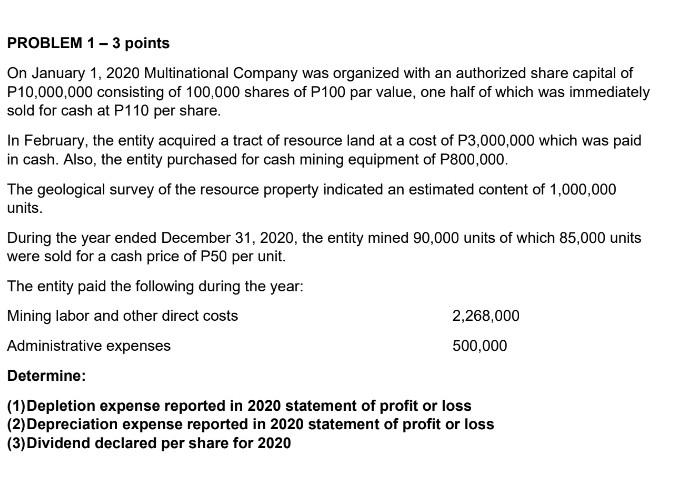

PROBLEM 1 - 3 points On January 1, 2020 Multinational Company was organized with an authorized share capital of P10,000,000 consisting of 100,000 shares of P100 par value, one half of which was immediately sold for cash at P110 per share. In February, the entity acquired a tract of resource land at a cost of P3,000,000 which was paid in cash. Also, the entity purchased for cash mining equipment of P800,000. The geological survey of the resource property indicated an estimated content of 1,000,000 units. During the year ended December 31, 2020, the entity mined 90,000 units of which 85,000 units were sold for a cash price of P50 per unit. The entity paid the following during the year: Mining labor and other direct costs 2,268,000 Administrative expenses 500,000 Determine: (1) Depletion expense reported in 2020 statement of profit or loss (2)Depreciation expense reported in 2020 statement of profit or loss (3) Dividend declared per share for 2020

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts