Question: Problem 1 (30 marks) Insoled Ltd. issued bonds with the following provisions: Face value: $60,000,000 Coupon rate: 7.9% per annum Interest payment dates: Semi-annually, each

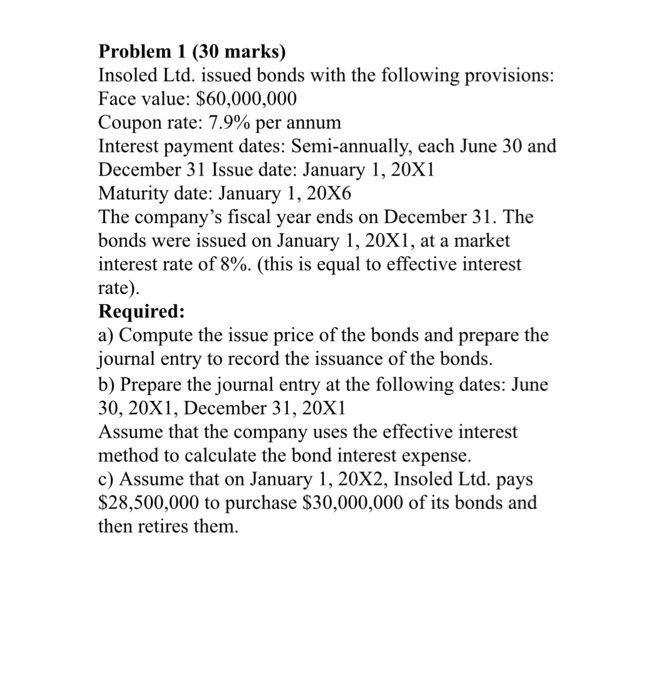

Problem 1 (30 marks) Insoled Ltd. issued bonds with the following provisions: Face value: $60,000,000 Coupon rate: 7.9% per annum Interest payment dates: Semi-annually, each June 30 and December 31 Issue date: January 1, 20Xl Maturity date: January 1, 20X(6 The company's fiscal year ends on December 31. The bonds were issued on January 1, 20X1, at a market interest rate of 8%. (this is equal to effective interest rate) Required: a) Compute the issue price of the bonds and prepare the journal entry to record the issuance of the bonds. b) Prepare the journal entry at the following dates: June 30, 20X1, December 31, 20X1 Assume that the company uses the effective interest method to calculate the bond interest expense c) Assume that on January 1, 20X2, Insoled Ltd. pays $28,500,000 to purchase $30,000,000 of its bonds and then retires them

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts