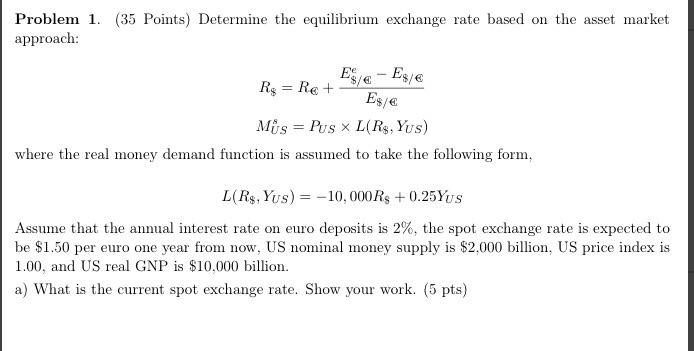

Question: Problem 1. (35 Points) Determine the equilibrium exchange rate based on the asset market approach: Ese - E9/ R$ = Re + Ese Ms =

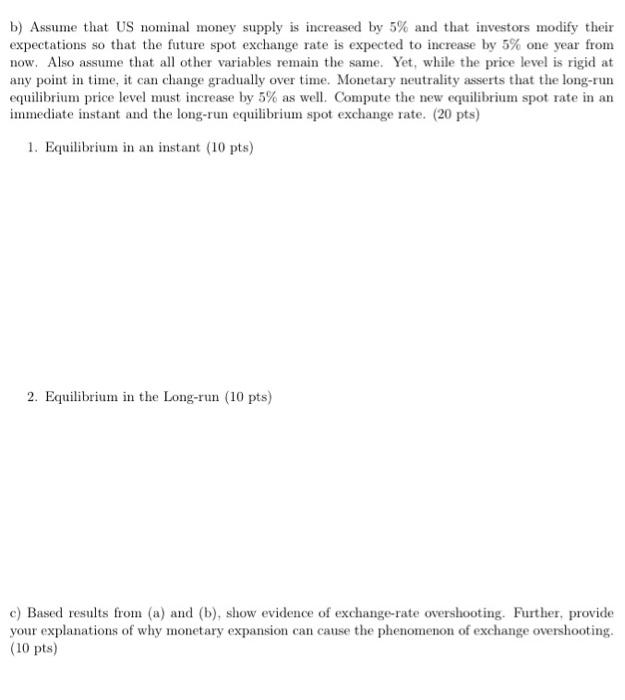

Problem 1. (35 Points) Determine the equilibrium exchange rate based on the asset market approach: Ese - E9/ R$ = Re + Ese Ms = Pus x L(R$, Yus) where the real money demand function is assumed to take the following form, L(R$, YUS) = -10,000 R$ +0.25YUS Assume that the annual interest rate on euro deposits is 2%, the spot exchange rate is expected to be $1.50 per euro one year from now, US nominal money supply is $2,000 billion, US price index is 1.00, and US real GNP is $10,000 billion. a) What is the current spot exchange rate. Show your work. (5 pts) b) Assume that US nominal money supply is increased by 5% and that investors modify their expectations so that the future spot exchange rate is expected to increase by 5% one year from now. Also assume that all other variables remain the same. Yet, while the price level is rigid at any point in time, it can change gradually over time. Monetary neutrality asserts that the long-run equilibrium price level must increase by 5% as well. Compute the new equilibrium spot rate in an immediate instant and the long-run equilibrium spot exchange rate. (20 pts) 1. Equilibrium in an instant (10 pts) 2. Equilibrium in the Long-run (10 pts) c) Based results from (a) and (b), show evidence of exchange-rate overshooting. Further, provide your explanations of why monetary expansion can cause the phenomenon of exchange overshooting. (10 pts) Problem 1. (35 Points) Determine the equilibrium exchange rate based on the asset market approach: Ese - E9/ R$ = Re + Ese Ms = Pus x L(R$, Yus) where the real money demand function is assumed to take the following form, L(R$, YUS) = -10,000 R$ +0.25YUS Assume that the annual interest rate on euro deposits is 2%, the spot exchange rate is expected to be $1.50 per euro one year from now, US nominal money supply is $2,000 billion, US price index is 1.00, and US real GNP is $10,000 billion. a) What is the current spot exchange rate. Show your work. (5 pts) b) Assume that US nominal money supply is increased by 5% and that investors modify their expectations so that the future spot exchange rate is expected to increase by 5% one year from now. Also assume that all other variables remain the same. Yet, while the price level is rigid at any point in time, it can change gradually over time. Monetary neutrality asserts that the long-run equilibrium price level must increase by 5% as well. Compute the new equilibrium spot rate in an immediate instant and the long-run equilibrium spot exchange rate. (20 pts) 1. Equilibrium in an instant (10 pts) 2. Equilibrium in the Long-run (10 pts) c) Based results from (a) and (b), show evidence of exchange-rate overshooting. Further, provide your explanations of why monetary expansion can cause the phenomenon of exchange overshooting. (10 pts)